USDA: The Trade Awaits

Here we go again then, the global grain trade hanging on the word of a bunch of buffoons with a Spectrum ZX and some coloured pencils. No sharpeners of course, they aren't allowed sharpeners in there.

The general concensus is that the early start to plantings this spring will have led to a bit more corn going in than was anticipated back in March. Soybean and wheat area is seen broadly little changed.

You will note though that we have roughly a 2 million acre spead between the range of guesses for both beans and corn, that does leave room for a bit of a surprise for one or the other.

You may recall it was surprises all round last June when the USDA found a million more wheat acres, one and a half million more soybean acres AND two million more corn acres than they had in March. No losses just gains all round.

Last year the corn number was the biggest surprise of all, coming in a million acres higher than the highest trade estimate, and two and a half million above the average trade guess.

Here's a note of what is expected from them on Wednesday:

June Acreage (million acres):

Avg Est Range Mar USDA 2009

--------------------------------------------------------

Soybeans 78.183 76.528-78.900 78.100 77.500

Corn 89.229 88.100-90.153 88.800 86.500

All wheat 53.825 53.500-54.087 53.800 59.133

--------------------------------------------------------

June 1st Stocks (billion bushels):

Soybeans 0.594 0.580-0.620 1.270 0.596

Corn 4.598 4.459-4.784 7.694 4.261

Wheat 0.940 0.929-0.950 1.352 0.657

--------------------------------------------------------

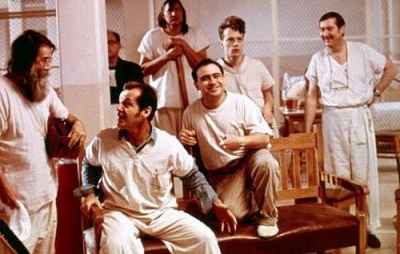

However, bearing in mind what happened last year, anything is possible. Here's an exclusive picture taken from inside USDA HQ as their analysts put the finishing touches to their estimates over the weekend:

CBOT Closing Comments

Soybeans

July soybeans closed at USD9.57, up 1 1/2 cents; July soybean meal at USD289.60, down USD0.50; July soybean oil at 37.16, down 1 point. Soybeans were down around 4 cents on the week. It was a quiet session with traders cutting exposure ahead of the weekend. The USDA are out on Wednesday with their June 2010 planting intentions report, and the trade is looking to tidy up open positions ahead of that.

Corn

July corn settled 4 1/4 cents lower at USD3.40 1/2; December corn ended 4 cents lower at USD3.60 1/2 a bushel. US weather conditions remain conducive to decent yields again this year. Yesterday's export sales were strong, and South Korea bought another 55,000 MT of US corn overnight. With Argentine set to have a record 2010 crop, sales need to hold up at these levels.

Wheat

July CBOT wheat closed at USD4.56 1/4, down 6 3/4 cents; July KCBT wheat at USD4.83 3/4, down 10 1/2 cents; July MGEX Wheat at USD5.12 1/4, down 12 1/2 cents. Wheat was down 26 cents on the MGEX futures for the week. Harvesting reports out of Kansas suggest that yields are better than expected. Canada remains a worry though. The quarterly grain stocks report will be out Wednesday, June 30th.

EU Wheat Closing Comments

EU wheat closed the week with little change, Nov London wheat was GBP0.20 higher at GBP103.25/tonne, and Nov Paris wheat EUR0.25 lower at EUR139.50/tonne.

Overall that's a loss of GBP2.25 on the week for London wheat and a loss of EUR2.25 for Paris wheat.

A firmer sterling and euro versus a weaker US dollar have pressured prices a bit this week, although production and quality uncertainties have underpinned price reductions.

Growers are busy and don't fancy these levels too much, but consumers are confident that new crop supplies from, shall we say less discerning sellers, will bring prices down anyway.

Tunisia bought 50,000 MT of any origin, probably Black Sea/French wheat, overnight.

With just one week of the marketing year to go, the EU-27 has issued a total of 17.69 MMT in soft wheat export licences this season. That's 17.5% down on last year, but better than what was expected a month or two ago.

The Biggest Thing In Farming For 10,000 Years

No, not Nogger's Blog, perennial grains. Those crazy wacky lovable loons the Americans reckon that the dream could soon(ish) become reality:

Stick Your Seed Catalogue Where The Sun Don't Shine (Canada for example)

They'll be telling is that eggs come out of chicken's arses next.

Early Call On CBOT

The overnight grains closed mixed with beans 2-4 cents higher, corn was just fractions into positive territory with wheat fractions the other way.

Crude oil and the dollar are both slightly firmer, but could go either way.

US weather remains largely non-threatening, with a cool down on the way for July 4th.

Rumours suggest that China has been back buying old crop US soybeans, but there have been no official confirmations as yet.

It could be a quiet tidying up pre-weekend session, with the USDA's planting intentions and stocks reports due next Wednesday.

South Korea bought 55,000 MT of corn, 30,000 MT of non-GMO soybeans and 55,000 MT of feed wheat overnight. Tunisia bought 50,000 MT of any origin wheat, probably Black Sea/French.

Early calls for this afternoon's CBOT session: Corn called 1 to 2 higher; Soybeans called 2 to 4 higher; Wheat called flat to 1 lower.

Hurry Up

There's only one left: Buy it now!

Canadian Rapeseed Latest

The Canadian Canola Growers Association says that rapeseed production in the world's largest exporter of the oilseed could fall 15% to around 10 MMT this year.

That's a cut of 1.8 MMT from last season, and around 2.5-3.0 MMT less than what had been anticipated earlier in the the year before the recent spring floods.

Growers only managed to seed about 85% of the crop they initially intended to, say the Association.

Those that did manage to plant now look like facing a variety of potential problems ahead. These include shallow rooting, late harvesting increasing the chances of frost damage, mould, disease and weed control.

EU Wheat Exports

Brussels issued export licences for 233,000 MT of wheat in the past week, making a year-to-date total of 17.69 MMT with just one week of the marketing year to go. That's 17.5% down on last season. France are the largest beneficiary accounting for 7.9 MMT of that, with Germany second on 4.9 MMT.

Total wheat imports to date are 3.02 MMT, 48% down on a year ago.

Ukraine Latest Latest

He's back on his yak, Ukraine agronomist Mike Lee has returned from a whistle stop four day tour of eastern and central Ukraine to bring us the inside story on what things are really looking like.

It's an open mike, Mike:

"The general condition is good, most crops looking well, harvest has started in Crimea, elsewhere wheat and barley is turning fast, OSR nearing desiccation, SF about to start flowering, soya nodulating, maize 1-1.5m. One slight worry is weather forecast is wet over the next few days, just hope it's not the start of a wet July."

When I asked Mike for his assessment on whether or not winterkill loss reports had been overstated. He said it was "difficult to assess, you can see patches in wheat where the water/ice sat, and it varies form next to nothing up to 20% of each field. The remaining plants look good it will be a question of how much crop is "missing".

"On the same vein, I talked to a dozen farm directors and agronomists over this week and when I asked them what their yield estimation was of the crop we were stood in front of at the time they all over-estimated by quite a lot. My estimations fitted in with the two UK farmer type chaps who where with me."

There's Something Wrong With The Weather

What's going on? It's Wimbledon and Glastonbury and it's sunny, warm and dry. There's something not quite right here. It's even dry in Scotland, yes Scotland, where the midges and ginger people live. They've only had a third of their normal deluge this month, and Scottish Water have confirmed they were preparing their first drought order in six years.

In Cumbria, yes the Lake District, that place where it always rains all day every day, unless there's a shooting going on. Yes here they are talking of hosepipe bans coming in next week. It has been the driest start to the year since 1929 in Cumbria they reckon, and of course usually they've got so much of the wet stuff that they're giving it away. To Manchester normally, where they are now also talking of hosepipe bans coming in. They won't be bothered as they never wash anyway, the dirty Mancs.

Now they are saying that Wales and the South West of England are next. That's the place they've dubbed the South Wets in recent years. Wales, it's always raining and miserable in Wales, I thought it was compulsory. They brought special laws in to make it miserable in Wales, that's why the pubs were always shut on a Sunday. You had to make your own entertainment on Sundays in Wales. You know what I mean don't you? Or should that be ewe know what I mean? "I'm just off up the top field to check the ewe's Myfanwy." "Bloody hell Idris, you're always off up there, checking them there ewes and that isn't it?"

So it looks like the Canadians have been getting all our weather then, a mix up at the weather office, something to do with similar postcodes. Canada, Cumbria, Saskatchewan, Sauchiehall Street, Manitoba, Manchester, Alberta, Aberystwyth there when you look at it like that it's easily done. Maybe we could import some Soil Association-approved GM-free rain in 25kg bags from them? It's worth looking into.

Ukraine Latest

The untrustworthy Ukraine Ag Ministry have lowered their 2010/11 grain crop production estimate to 45.0-45.5 MMT from 46-47 MMT.

That would represent a fall of around 5-6% on last season's 48 MMT.

Yet early harvest reports of mostly barley talk of better than expected yields, although progress has stalled this week as heavy rains hit the region.

It might be prudent to wait for some more reliable eye-witness reports to filter through next week, once our Ukraine correspondent Mike Lee gets back from his "one man on a yak" tour of some of the more remote parts of the country.

Canadian Crop Conditions

The word on the streets filtering through from assorted incoming emails from contacts in Canada suggests that, for once, crop conditions really are as bad as the media are making out.

Saskatchewan is the worst affected province, and also the one that grows more than half the nation's wheat. Saskatchewan Agriculture's weekly Crop Report (here), released yesterday afternoon, says that only 76% of the 2010 crop has been sown so far. That's an advance of only three percentage points from a week previously.

The north east is the worst affected region, with only half the intended area in the ground. Here 87% of spring sown cereals and 88% of oilseeds are also lagging in maturity. Over half the winter wheat and spring wheat crops are rated as poor/very poor, together with 43% of canola.

Brad Eggum reports of "scenes of devastation that showed a broad sweep of the province from the south west corner (which is usually quite desert like by now) in an arc to the north east. It would not be hard to believe that 1 acre in 3 would be underwater from what I viewed. Not to mention the acres through these areas that did not get sown."

Whilst things are better in Brad's locality in the south east, "the organic market had best perk their ears up as likely not more that 40% of intended organic acres made it in the ground, as they attempt to sow later for weed control. And 40% may be generous," he warns.

It seems pretty clear that quality as well as yields are likely to be serious issues in Canada this season. The lateness of plantings also creates potential vulnerability problems should winter arrive early this year.

Canada are the largest exporter of rapeseed in the world, typically accounting for around two thirds of all international trade. They also lead the world in the export of oats and are third in the global wheat export table.

You can view a map of where Canadian spring wheat is planted here.

Chicago Closing Comments

Soybeans

July soybeans closed at USD9.55 1/2, down 2 1/2 cents; November soybeans at USD9.12, down 11 1/2 cents; July soybean meal is at USD290.10, up USD0.80; July soybean ol is at 37.17, down 42 points. A further widening of the old crop-new crop spread was in evidence again today. Weekly export sales beat expectations and shipments were 42% higher than the four week average. The May census crush report was fractionally higher than trade guesses at 133.79 million bushels.

Corn

July corn closed at USD$3.33 3/4, down 1 3/4 cents; Dec corn was at USD3.64 1/2, down 1 cent. As with soybeans, weekly export sales were strong, with China buying 230,000 MT of old crop US corn. On a more bearish note Allendale say that US farmers have planted 89.707 million acres of corn this year, the largest area since 1944.

Wheat

July CBOT wheat ended at USD4.63, up 3/4 cent; July KCBT wheat was at USD4.94 1/4, down 3/4 cent; July MGEX wheat at USD5.24 3/4, down 7 1/2 cents. Weekly export sales were 720,600 MT against forecasts of sales of 250,000 to 450,000 MT. Warmer and dryer weather is predicted for the next 6 to 10 days, which should allow the US harvest to progress further north.

EU Wheat Ends Narrowly Mixed

In a subdued day of trading Nov London wheat closed GBP0.15 higher at GBP103.65/tonne, and Nov Paris wheat EUR0.25 lower at EUR139.75/tonne.

London wheat had been lower for most of the day as the pound briefly broke through 1.50 against the US dollar and 1.22 versus the euro.

But the surge to what was it's best in more than a month against the greenback, and it's highest in 19 months against the euro was relatively short-lived. That allowed London futures to recover losses close to the end of the session.

France are thought to have picked up a useful 400,000 MT export order to Algeria overnight, which was helpful to Paris wheat.

The IGC surprised the market by issuing a revised production estimate for world wheat in 2010/11 that was 4 MMT higher than last month, although the did also raise consumption by 4 MMT too, leaving ending stocks unchanged at 201 MMT.

Other analysts are reducing their production estimates, with Coceral yesterday lopping around a million tonnes off their EU-27 ideas. Earlier in the week Rabobank cut their world wheat estimate to 660 MMT, citing dryness in parts of Europe, high levels of winterkill in the Black Sea region and acute wetness in Canada.

According to a report by the Saskatchewan Government released after the close of the EU markets, only 76% of crops in the province have been seeded as of June 21st. Normally all the crops would be in the ground by now, and the deadline for crop insurance is now passed. Saskatchewan is Canada's leading wheat province growing 58 percent of the national wheat crop.

Yeah Right, Pull The Other One

There's an interesting little story here that starts off like this:

PALMER, Alaska — When Mike Henry began raising goats on his 5-acre farm north of Anchorage, he found the milking tough going. His hands ached, and the milk wouldn’t flow. He tied a piece of leather loosely around his doe’s back legs to keep her from kicking.

IGC Going Against The Grain

The London-based International Grains Council have today increased their global wheat production estimate for 2010/11 by 4 MMT to 664 MMT, saying that improved prospects in the US, China, Australia and Iran outweighed the anticipated lower output from Canada.

They also increased world wheat consumption by a convenient 4 MMT to 658 MMT, leaving bottom line ending stocks unchanged at 201 MMT, equivalent to around 112 days worth of supply.

I can only assume that they were trying to rush these figures through yesterday afternoon over a few prawn sarnies and lashings of G&T's so that they could settle down to watch the footie at 3pm, seeing as just about every other man and his poodle are revising their numbers lower.

"Up four on supply, matched by up four on demand, what do you say Tarquin?"

"Bally good idea to me Peregrine old chap, fill her up again will you, and I'll have a slice of lemon this time. I say, are we the chaps in red or the bounders in white? Rugger's my game really, too much kissing with these footie wallers dontyaknow, bottom fettlers the lot of 'em if you ask me. We didn't have none of those shenanigans in my day. Tompkins-Smythe, our old PE teacher, used to make us play stark naked if we forgot our kit you know. He was a hard man, hard but fair. He forgot his kit quite a few times too as I recall...."

An official from the IGC, possibly

Early Call On Chicago

The overnight grains closed modestly higher, with beans up around 2-4 cents, corn up one and wheat around 2 cents firmer.

The dollar is flat and crude oil a bit weaker after the US Energy Dept said stocks rose 2 million barrels last week.

Export sales were strong for beans, corn and wheat - exceeding trade expectations for all three. China was also a featured buyer of old crop corn, in addition to buying beans for both old and new crop.

The May census crush report was fractionally higher than trade guesses at 133.79 million bushels.

Allendale say that US farmers have planted 89.707 million acres of corn, the largest area since 1944. They peg the 2010 US soybean area at 77.609 million and wheat area at 54.095 million, the lowest since 1971.

The corn number is almost a million higher than the USDA, with the soybean area estimate half a million lower.

Early calls for this afternoon's CBOT session: Corn called flat to 2 higher; Soybeans called 2 to 4 higher; Wheat called 1 to 3 higher.

USDA Export Sales

Today's USDA weekly export sales report beat traders' forecasts for soybeans, corn and wheat. Old crop corn sales also included 230,000 MT for China.

Wheat sales came in at 720,600 MT against forecasts of 250,000 to 450,000 MT. Soybean sales were 308,300 MT old crop and 233,000 MT new crop against forecasts of 350,000 to 500,000 MT. Corn sales were 1,123,400 MT old crop and 332,300 MT new crop, against estimates of 650,000 MT to 1 MMT.

Unknown was the largest wheat buyer taking 244,500 MT. Japan took 442,300 MT of the old crop corn followed by China with 230,000 MT. Japan was the largest old crop soybean buyer with 146,600 MT, although China also took old (64,100 MT) and new crop (58,000 MT).

Waiting On The USDA

It's a very boring, very quiet, no footie to look forward to sort of a day today. It's coming to something when we are relying on the USDA to liven things up this afternoon.

They're out with the May census soybean crush numbers and the weekly export sales reports this afternoon.

The trade expects 133.2 million bushels of soybeans to have been processed by US crushers last month, sharply down on the 146.2 million crushed in May 2009.

Meanwhile weekly export sales for soybeans are expected to come in around 350,000 to 500,000 MT, corn at 650,000 to 1 MMT and wheat at 250,000 to 450,000 MT. China may have booked some corn according to rumours circulating earlier in the week, will they show up today?

I'm Having A Bad Day

Up early, slightly hungover after "just a couple of shandies" whist watching the England game turned a bit messy.

Walking the dog round the local park trod in something I shouldn't have, something left there by another dog. Can you guess what it was if I tell you the colour? Suffice to say it wasn't any of the very rare these days white stuff.

I think that the local Indian must have left the back door open again, and that Great Dane from No 64 helped himself to several large buckets of prawn Madras that they'd left out for the binmen.

They were a new pair of trainers those as well. I was going to chuck them, but on second thoughts I might put them in for the next Egyptian wheat tender, you never know.

And now something keeps "dinging" upstairs. Every thirty seconds or so. Buried deep inside the kids' bedrooms somewhere. Like the noise you get in Asda before the call for a colleague from Home and Leisure to go to the customer service desk, where a man clutching a five year old sandwich toaster wants to know if he can have his money back "cos this one's got stuff stuck to it".

There it goes again. Where did I put that hammer?

Back In The Summer Of '76

Yes folks a week of sunshine and temperatures into the upper 20's C and the papers are already likening this summer to the "great drought" of 1976.

It may surprise many of you to hear that I was not simply "a twinkle in me Dad's eye" back then, but actually a lithe youth with a 26 inch waist as I recall.

We went on holiday to Scarborough that year, and I remember there being loads of ladybirds about. I don't mean a few more than normal either, I mean millions of them, everywhere. Everywhere you went you were ankle deep in dead ladybirds.

Hosepipe bans were in place, and your Mum had to sneak out into the garden, face fully blackened up, at 1am to water the plants.

Well, we could be in for a repeat of 1976 this year they reckon. So get those standpipes ready.

Wheat Tenders Egyptian Style

There are some classic lines in this story on a new look Bloomberg site here, which suggests that Egypt would like to cast it's net a bit wider as far as wheat tenders are concerned.

“The origin countries are like my children and I would like to see all children equal in everything.”

I have this mental image of an aging overweight heavily hirsute mustachioed man smoking a cigar in a jacuzzi, dripping in gold chains and rings, whilst nubile eastern European "ladies" serve him champagne and "things".

"Come on in, the water's lovely, what harm could it do eh?"

CBOT Close

Soybeans

July soybeans closed at USD9.58, down 7 1/2 cents; July soybean meal is at USD289.30, down USD1.40; July soybean oil at 37.59, down 34 points. It was a quiet day. Weekly export sales estimates range from 350-550,000 MT for soybeans, and 50-150,000 MT for soybean meal. The trade will be hoping that Chinese buying continues to feature.

Corn

July corn closed at USD3.46 1/2, down 5 cents; Dec corn was at USD3.65 1/2, down 6 1/2 cents. Many areas of the Midwest have been hit with heavy rains and are dealing with flooding. "A wave train of thunderstorms keeps sweeping across the Midwest delivering heavy rainfall. Presently, 64% of US corn and US soybean farms are excessively wet," say Martell Crop Projections.

Wheat

July CBOT wheat ended at USD4.62 1/4, up 1 1/4 cents; July KCBT wheat at USD4.95, up 1 cent; July MGEX Wheat at USD5.32 1/4, down 2 1/2 cents. Weekly export sales estimates for tomorrow range from 250-450,000 MT. Stats Canada reported that the seeded area for Canadian all wheat was 22.7196 million acres versus 24.4569 million acres in 2009. That is almost certainly far higher than reality.

EU Wheat Closing Comments

EU wheat futures close with Nov London wheat down GBP0.75 at GBP103.50/tonne, and Nov Paris wheat EUR0.25 higher at EUR140.00/tonne.

A sharply higher pound depressed UK wheat prices.

French analysts Coceral said that EU-27 soft wheat production would come in at 132.22 MMT this year, almost a million tonnes down on their last estimate in March. All wheat output will amount to 140.07 MMT, according to them.

UK wheat output will amount to 15.88 MMT, with France producing 37.50 MMT and Germany 25.6 MMT, they say.

EU-27 barley production will come in at 55.3 MMT, down 14% on last year, they add.

These figures are still very much pie in the sky, and EU prices appear to be treading water until we get a clearer picture on final production estimates here.

With the harvest now underway in southern France, within a month or so we should have a much better idea on where final production numbers are likely to be.

Stats Canada...

...are out today with their acreage figures for 2010, although they are highly questionable as they are based on a survey that finished on June 3rd, long before Canadian farmers had given up on seeding hopes. It remains to be seen how much credence the trade gives these this afternoon.

For what they are worth here's the scores on the doors (in million acres):

2010 2009/10

---------------------------------

Canola 17.894 16.199

All Wheat 22.719 24.457

Barley 8.051 8.663

Oats 3.737 3.731

The Rapeseed Market

Whilst other agri commodities have underperformed so far during 2010, rapeseed has been a little shining star. The Nov 2010 Paris rapeseed future, currently EUR4.50 higher on the day at EUR338.25/tonne, has risen by almost 15% so far this year, the only major grain/oilseed to post any sort of advance at all:

Change On Year

Paris Nov Rapeseed +14.7%

London Nov Wheat -9.3%

Paris Nov Wheat -1.8%

Paris Nov Corn -0.1%

CBOT Dec Wheat -16.4%

CBOT Nov Soybeans -7.9%

CBOT Dec Corn -15.8%

What's behind the rise, and is it likely to continue?

Well, rapeseed is only a pretty small global crop of course. At 55-60 MMT it's less than a tenth of the size of world wheat production, less than a quarter of the world soybean crop and fourteen times smaller than corn.

That makes it more vulnerable to taking a hit if one of the major producers has a problem. And this year production is taking a hit in the world's two largest producers: Canada and China.

China will produce 13 MMT of rapeseed this year, according to the USDA. Just about everybody else outside of China thinks that production will be much less, possibly even below 10 MMT, and at the very most 11.5 MMT. See: China Rapeseed Output May Miss U.S. Estimate by 15%, Group Says

Consumption in China meanwhile will hit a record 15 MMT in 2010/11, according to the USDA.

The planting problems in Canada have already been well documented, and remember that they are the largest exporter of rapeseed in the world, typically accounting for around two thirds of all international trade. Whist the trade is concerned over what hasn't managed to get sown this year, it doesn't yet seem to have switched it's attention to the ill-health of much of what has got into the ground. Or, judging by the reports of desperate farmers sowing by plane, should that be onto the ground or into the water?

Closer to home, lower output is expected from Europe's top two producers of France and Germany, whilst flooding in Poland is seen causing the crop in what was Europe's third largest producer last year to also shrink. A small amount of harvesting has already taken place in Ukraine, where winterkill problems have also been widely documented.

Europe is expected to consume almost 24 MMT of rapeseed in 2010/11, but with production looking likely to come in at only 21 MMT or less, we'll be looking to import 3 MMT ourselves this year. That's 85% of the entire world's exports in 2009/10 outside of Canada.

Pound Jumps Ahead Of England Game

The pound is up this morning in anticipation that thousands of England fans, currently away from home supporting the African economy, will be returning to these shores by the weekend before indulging in a massive drinking spree shovelling billions across the bars of the nation.

Meanwhile, the three of us who remained at home will be rushing into town at lunchtime to buy the last of the XL replica shirts and snap up a few more flags for the roof of the car. JJB Sports have laid on extra staff to cope with the expected surge in demand, whilst Bargain Booze have stocked up on extra strong lager in a move that is seen potentially wiping out the national debt in one swift afternoon.

Meanwhile the minutes of the BoE's MPC meeting earlier this month showed a unanimous vote to maintain QE at GBP200 billion. Yesterday's "not as austere as it might have been" Budget seems to be getting the thumbs up from the city too.

Three Loins On My Shirt:

Australian Canola Latest

This year's Australian canola crop will be the largest since 1999/2000 at 2.215 MMT, according to the Australian Oilseeds Federation. Good rains in Victoria, NSW and South Australia are behind the increase, along with higher plantings in Victoria and NSW, they say.

West Australian canola production is forecast down to 1.03 MMT from 1.18 MMT last month on lingering dryness, they add.

Output in Victoria is forecast at 415,000 MT, NSW 480,000 MT and Southern Australia at 290,000 MT.

"Victoria had a very strong start to the season, following the summer rain and the continued lower wheat prices have driven a further increase in the area," they said.

Their forecast is more than 250,000 MT higher than ABARE's current estimate of 1.96 MMT.

Going Into Administration Today Is

Fords Bakery of Prestonpans, East Lothian. Which had nine shops, 67 employees and an annual turnover (pun?) of GBP5 million. Lack of dough was the problem according to the administrator, KPMG, who said that the bakery faced severe cash flow problems during the economic downturn.

Kazakh Rumblings

Newly arrived onto the international wheat export scene, Kazakhstan isn't facing such a bumper harvest in 2010. Soaring temperatures topping 100C and very scant rainfall since spring crops were planted into a dry seedbed could cut wheat production quite sharply this season.

Karim Masimov, the Kazakh Prime-Minister has prophetically said that the nation has sufficient grain stocks to cover it's domestic needs in the event of a bad harvest this year.

Meanwhile Kazakhstan agribusiness Altyn Mai are to open a new flour mill in southwestern Kazakhstan worth 1.25 billion tenge (two pounds fifty), which will process 11,000 MT of wheat a month from the company's own farms in the Altynsarinskom and Mendykarinskom regions.

I Had A Dream

Capello makes a few changes, but England make another inept start and are a man and a goal down at half time after a controversial sending off. Joe Cole comes on with half an hour to go and completely turns the game around, suddenly it's 1-1 and England are all over them, but fail to score a vital winner. Back to the studio for angst, indignation and cries of "why didn't he bring him on sooner"? The end.

CBOT Closing Comments

Soyebans

July soybeans closed at USD9.65 1/2, up 2 1/4 cents; July soybean meal is at USD290.70, up $1.80; July soybean oil is at 37.93, down 12 points. Demand from China remains robust, even without any gains from it's local currency, as witnessed by further sales of old crop US soybeans yesterday.

Corn

July corn was at USD3.51 1/2, down 3 1/2 cents; Dec corn it USD3.72, down 2 3/4 cents. The US dollar was strong, and crude oil weak, which added ed some bearishness today. Demand from China remains robust, even without any gains from it's local currency, as witnessed by further sales of old crop US soybeans yesterday

Wheat

July CBOT wheat ended at USD4.60 3/4, down 1 1/4 cents, July KCBT Wheat was at USD4.94, down 5 3/4 cents; July MGEX wheat at USD5.34 3/4, down 5 1/2 cents. US weather conditions for the 6 to 10 day forecast are calling for above normal temps and below normal rain that should allow the wheat harvest to move forward in the Midwest.

EU Wheat Closing Comments

EU wheat ends with November London feed wheat down GBP1.25 at GBP104.25/tonne, and November Paris wheat EUR1.25 lower at EUR139.75/tonne.

Tender news was thin on the ground. Whilst German wheat won a reported 880,000 MT of the Saudi 990,000 high protein wheat tender over the weekend, French wheat did dip out again on Egypt's latest tender.

Harvesting is underway in Ukraine, with 88,500 ha of barley (producing 237,000 MT) cut as of June 21st, according to the Ag Ministry. A small amount of wheat and rapeseed has also bee harvested, they add.

Harvesting will also begin in southern France this week, according to medias reports.

Floods in eastern Europe awe a concern, with significant yield losses being predicted in Poland and the Czech Republic.

How Do You Confuse An Egyptian?

Despite continuing to buy Russian wheat at knock down prices that Europe and beyond can't and won't match, the penny doesn't yet seem to have quite dropped with the lovable Egyptians.

If you shop at the ten cent store, then you get a lame flea-bitten ten cent yak (probably called Emile), not a diamond encrusted gold-plated Rolls Royce:

Egypt to re-export a Russian wheat cargo

Budget Implications#1

Proud possessor of the poisoned chalice, George Osborne, has increased the VAT rate from 17.5% to 20% in today's Budget. As a sop to please the masses, he's resisted the temptation to slap further increases on "essential food items" such as beer and fags.

The VAT increase will of course also apply to fertiliser, but it doesn't come into effect until January 4th 2011. Cue the rush of fertiliser manufacturer's promotional literature being sped to the printers as I type: "we've only got one load left honest, buy now to avoid the VAT increase, the Indians/Chinese will take it if you don't want it, etc."

Early Call On CBOT

The overnights closed mixed with beans up 1 1/2 to down a half, corn was mostly down a couple of cents and wheat generally 3-4 cents easier.

The dollar is up and crude oil is lower.

The euphoria over China's weekend announcement that it would allow the yuan to appreciate has been short-lived. Most analysts are now saying that only very modest gains will be likely to be tolerated.

Demand from China remains robust, even without any gains from it's local currency, as witnessed by further sales of old crop US soybeans yesterday. Unconfirmed rumours today suggest that they also bought more US corn overnight.

The first US corn cargo of the recent raft of Chinese purchases has however arrived and been cleared by customs without problems, according to media reports.

Last night's USDA reports showed crop conditions declining somewhat, albeit from pretty high levels. Some states showed some pretty steep declines though, which may keep the market a little nervous from pressing the downside too much.

The trade will now be keeping an eye on Thursday's upcoming export sales report, followed by next week's June acreage and stocks reports from the USDA.

"Heavy rain and severe weather will continue to hit the Plains and Corn Belt this week. The latest mid-term outlook now shows a cool-down and soaking rains for the Ohio Valley and Upper Delta as July arrives," according to QT Weather.

The USDA last night said that 16% of soybeans in Ohio remain unplanted, the crop is normally 100% done by now.

Early calls for this afternoon's CBOT session: Corn called 1 to 3 lower; Soybeans called mixed; Wheat called 2 to 4 lower.

Morning Snippets

It's Budget Day, which might mean a volatile afternoon for the pound. New Chancellor George Osborne has his work cut out, there are some reports that he may increase VAT from 17.5% to 20%, or reduce the rules as to which items are exempt from VAT, like children's clothes.

The weather is the US is ruffling a few feathers, with hot and dry conditions in the Mississippi Delta seeing Louisiana soybeans rated good/excellent fall 16 points in a week. Planting progress was slow this past week, most notably in Ohio, where only 84% of the soybean crop is in the ground, the crop is normally fully planted by now.

Australia are the latest country to accuse the US of dumping biodiesel on it's doorstep and niftily claiming two sets of subsidies as it goes. Where have we heard that one before?

Harvesting is underway in Ukraine, with 88,500 ha of barley (producing 237,000 MT) cut as of June 21st, according to the Ag Ministry. A small amount of wheat and rapeseed has also bee harvested, they add.

Japan are looking for 125,500 MT of wheat in their usual weekly tender, of which 90,000 MT will be US origin.

CBOT Closing Comments

Soybeans

July soybeans closed at USD9.63 1/4, up 2 1/4 cents; July soybean meal at USD288.90, down USD0.50; July soybean oil is at 38.05, up 13 points. Support came from firmer crude oil and news that China would allow the yuan to appreciate against the dollar, theoretically enabling them to import even more US soybeans than before. The USDA also confirmed the sale of 120,000 MT of US soybeans to China overnight. Wet weather in the US means that soybean plantings advanced only 2% for the week, to 93% done. Crop conditions also fell with good/excellent losing 4% from last week.

Corn

July corn closed at USD3.55, down 5 3/4 cents; Dec corn ended at USD3.74 3/4, down 5 3/4 cents. Today's USDA export inspections for corn were disappointing at only 24.488 million bushels. After the close, USDA reported a drop in crop condition ratings of two points, with 65% rated good/excellent vs 67% last week. News that China would abolish it's system of maintaining a fixed yuan/dollar exchange rate was seen as friendly for commodities in general.

Wheat

July CBOT wheat closed at USD4.62, up 1/4 cents; July KCBT wheat at USD4.77 1/4, down 3/4 cents; July MGEX wheat at USD5.40 1/4, up 2 cents. US export inspections last week were a disappointing 11.46 million bushels. After the close, USDA reported winter wheat harvest is still well behind the normal pace. Only 17% has been harvested, vs. the 5-year average of 23%. Winter wheat conditions fell a point to 65% good/excellent. Spring wheat was rated 84% rated good/excellent, down 2 points from last week. Wet weather in the Canadian Prairies remains a concern.

EU Wheat Closing Comments

EU wheat futures closed mostly flat to lower, with Nov London wheat ending unchanged at GBP105.50/tonne, and November Paris wheat down EUR0.75 at EUR141.00/tonne.

Saudi Arabia buying the majority of it's 990,000 MT wheat tender as German grain over the weekend was clearly supportive, even if Egypt did pass on EU origins to buy Russian/Kazakh wheat.

The euro seems to have moved sufficiently low enough for the time being however, which removes one of the elements that has been underpinning EU wheat of late.

The barley harvest is expected to begin this week in southern France, and has already begun in Ukraine, Bulgaria and other eastern European countries.

Flooding in places like Poland and the Czech Republic may lead to lower cereal output than had been anticipated a few months ago.

Further east lack of rain is the problem, with reports emanating from Kazakhstan suggesting that a spring drought may cut wheat yields quite significantly this season. The USDA currently has them down to produce 17 MMT of wheat this year.

Weekend News

Perhaps the biggest news for the grain markets emerging over the weekend was the Chinese announcing that they were to allow the yuan to appreciate, rather than remain fixed against the dollar.

That saw the local currency appreciate to it's highest levels against the US unit since it was revalued back in July 2005.

That saw commodities rise across the board on ideas that a strengthening yuan will see Chinese import continue to rise. Copper rose the most in a month, zinc is up 4.3 percent and aluminum rose 3.6 percent. Crude oil is at its best levels in more than a month, whilst eCBOT wheat, corn and soybeans are also higher.

German wheat featured in Saudi Arabia's monster 990,000 MT weekend wheat tender, although Egypt's poxy 120,000 MT tender went to Russia/Kazakh wheat.

EU grain have also opened higher, with rapeseed up EUR5 or thereabouts, correcting Friday's correction!

Saudi's Buy German/Canadian Wheat

Saudi Arabia are reported to have bought a combination of German and Canadian wheat in their huge 990,000 MT wheat tender concluded over the weekend.

Although details are scant, ten cargoes will be shipped into the west coast port of Jeddah and eight to the eastern port of Dammam.