eCBOT Close/Early Call

eCBOT grains closed higher supported by a sharply weaker dollar. Beans ended the overnight session around 5-7c firmer, with corn 4-5c higher and wheat up 6-8c.

With US interest rates now effectively at zero, there is a growing concern that the dollar's safe-haven status is no more. All of a sudden rates of 2.75% in the Eurozone look positively stratospheric.

This may help US grains exports in 2009. At least that's the theory.

Strategie Grains peg the EU 2009/10 grain production down 6% to 292mmt, with wheat production down 5.4% to 132.7mmt.

The Australian wheat crop is still under threat of further quality downgrades as rain continues to hamper harvest progress in WA, NSW and Victoria.

The Argy wheat crop has been downsized by the Ag Secretariat to 9mmt, almost 44% down on last year.

Russia's 2008 grain harvest is now put at a final figure of 105.5mmt in clean weight by the Russian Ministry. They will double their intervention purchases to 20mmt to shore up prices and insure against a crop disaster in 2009, they say.

Assorted wheat tenders are kicking around, with Japan buying US/Australian wheat, Jordan taking Russian wheat and Israel booking Ukraine wheat.

Waiting in the wings are Pakistan tendering for 500,000mt US wheat for completion Dec20th and Saudi Arabia tendering for a similar quantity of optional origin 12.5% protein wheat for completion by 5th Jan.

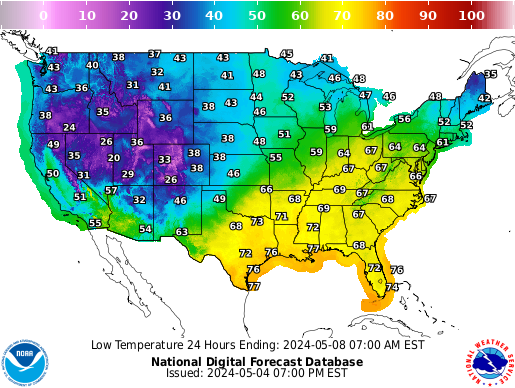

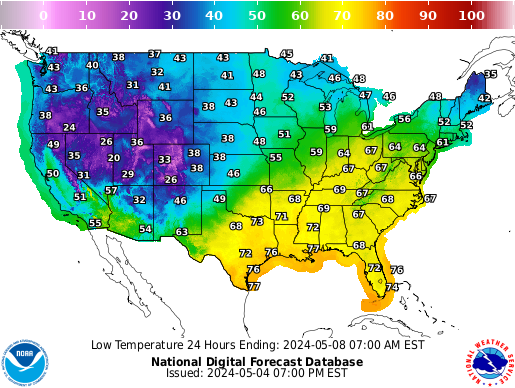

Another very cold weekend is in store for the US Plains, putting winter wheat crops under threat of winterkill.

Early calls for this afternoon's CBOT session: Corn futures are expected to open 4 to 6 higher; soybeans 5 to 7 higher; wheat 6 to 8 higher.

With US interest rates now effectively at zero, there is a growing concern that the dollar's safe-haven status is no more. All of a sudden rates of 2.75% in the Eurozone look positively stratospheric.

This may help US grains exports in 2009. At least that's the theory.

Strategie Grains peg the EU 2009/10 grain production down 6% to 292mmt, with wheat production down 5.4% to 132.7mmt.

The Australian wheat crop is still under threat of further quality downgrades as rain continues to hamper harvest progress in WA, NSW and Victoria.

The Argy wheat crop has been downsized by the Ag Secretariat to 9mmt, almost 44% down on last year.

Russia's 2008 grain harvest is now put at a final figure of 105.5mmt in clean weight by the Russian Ministry. They will double their intervention purchases to 20mmt to shore up prices and insure against a crop disaster in 2009, they say.

Assorted wheat tenders are kicking around, with Japan buying US/Australian wheat, Jordan taking Russian wheat and Israel booking Ukraine wheat.

Waiting in the wings are Pakistan tendering for 500,000mt US wheat for completion Dec20th and Saudi Arabia tendering for a similar quantity of optional origin 12.5% protein wheat for completion by 5th Jan.

Another very cold weekend is in store for the US Plains, putting winter wheat crops under threat of winterkill.

Early calls for this afternoon's CBOT session: Corn futures are expected to open 4 to 6 higher; soybeans 5 to 7 higher; wheat 6 to 8 higher.