Bulgarian Barley Harvest 70 Pct Done

The barley harvest in Bulgaria is 70% done, according to UkrAgroConsult.

Despite frequent showers, the warm weather and winds have helped farmers to make good progress in harvesting this past week, they say.

So far there are no worries about the quality of the barley from the new crop. Test weight is an average of 64 kg/hl, moisture is normal, below 14,5%, and admixtures are within 1-2%.

Some concerns have been expressed about the quality of the malting barley – but so far the new is mostly positive, they conclude.

Backhanders

In tonight's episode of Backhanders mysterious Egyptian wheat buyer Nomoney Nomoney gets into a fight with Phil and Grant down the Queen Spick when he asks for his $10 million back, Ashraf Ihadnothingtodowithit Atall Atall realises that he can't be the father of Ian Beale's love child and Nick Cotton gets a job as a cargo superintendent.

EU Wheat Ends Flat To Slightly Lower

EU wheat futures ended a quiet day Friday flat to slightly lower in very subdued trade.

Paris November milling wheat ended down EUR0.50 at EUR141.25/tonne, and London November feed wheat closed unchanged at GBP112/tonne.

With the markets in the US closed for the Independence Day holiday, it was always likely to be a quiet affair, and so it proved.

In London only 88 lots traded all day, with business wittily described by one trader as a steaming pile of faeces.

We're into July and the combines are rolling across much of Europe, and we'll soon begin harvesting here in the UK, so I guess we shouldn't be too surprised that it's quiet and the market is depressed.

EU wheat has got a bit of a boost with Egypt buying french wheat a couple of times in the past fortnight as their dispute with Russia over quality issues drags on.

Despite both sides publicly stating that the problem is internal to Egypt one Russian cargo still sits at the docks in Egypt impounded by the authorities until the state get their money back for a previously disputed shipment.

Brazilian Soybean Exports At Record Pace

Brazil has exported a record 19 MMT of soybeans in the first half of 2009, according to the Brazilian Trade Ministry. That's more than three-quarters of their anticipated exports for the entire year of 24.8 MMT.

Exporters have been keen to cash in on high Chicago prices, strong Chinese buying, the crop failure in Argentina and the large inverse between front-end and deferred month contracts.

Brazil is expected to utilise around 30 MMT domestically of it's 57 MMT soybean produced this year, leaving around 25 MMT to export, with a little bit left for carryover into 2010.

The phenomenal pace of Brazilian exports is pushing up domestic premiums, with August delivery Paranagua currently running at a premium of $1.40 per bushel over August in Chicago.

They will of course be conscious of a large US crop hitting the market in a couple of months time. With the problems in Argentina, this potentially leaves the US as the only shop in town during Q4 of 2009 and Q1 2010.

EU Grain Exports Up 60 Pct

With just one week of the marketing year left to report on, the EU had granted 30.4 MMT of grain export licences, up 60% from the level of 18.9 MMT a year ago.

Of that total, soft wheat export licences amounted to 22 MMT.

Unsurprisingly, grain import licences have been issued on substantially less volume this season, 57% lower at 11.3 MMT from 27.4 MMT a year ago.

Argentina Drought Ongoing

The drought in Argentina which has lasted around eighteen months now is ongoing, with only southern and eastern parts of Buenos Aires province receiving beneficial rains in June:

As it happens the south and east of Buenos Aires province is the country's most productive wheat growing area, accounting for around half of national production.

The other main growing areas are the eastern half of Cordoba, western Santa Fe and eastern La Pampa, which have all had less than half of normal rainfall during June.

Egypt's GASC Under Investigation, BBC Buy TV Rights

Egypt's state-owned wheat buyer GASC is under investigation for it's part in the recent problems with quality on imports from Russia, according to media reports.

The country's state prosecution office is said to be in the middle of an ongoing investigation, which might be criminal, into GASC and Egyptian Traders Co, the company at the centre of the recent row.

GASC have interestingly steered well clear of Russian purchases in it's last two recent tenders, despite Russian wheat being offered cheaper than other origins, instead buying French and US wheat.

The BBC have bought the TV rights to the saga and are said to be "at an advanced stage" of launching a new TV soap surrounding the Egyptian wheat trade called Backhanders. The soap will be centered around a fictional area of Cairo called Dilbert Square.

In it Ross Kemp will be blacked-up to play GASC chairman Nomoney Nomoney, with the part of the Egyptian Traders Co CEO and chairman of the Egyptian feed trade body GUPTA, Ashraf Ihadnothingtodowithit Atall Atall, going surprisingly to Peter Andre 'because he looks foriegn'.

I Never Thought I'd Feel Sorry For An Argie

But today I almost do, the poor buggers, quite literally. Not only does your average man on the streets now have a lower per capita income than his counterpart in neighbouring Chile.

Crippled by drought, inflation, punitive taxes and crippling red tape the agricultural sector has gone to the dogs.

The Agricultural Secretariat haven't put out a crop estimate since March, the one that was famously withdrawn after a couple of hours because it 'contained errors'.

In 2008, for the first time ever, Argentina exported less beef than Uruguay, despite being almost fifteen times bigger.

They're set to produce less wheat than they consume in 2009.

Now the poor sods have raging swine flu.

Trading on the Buenos Aires Grain Exchange floor was suspended yesterday, with traders having to phone in with offers and bids.

Seventeen provinces have closed schools and colleges in an attempt to combat the outbreak of H1N1 influenza.

And they've leapt to third in the list of the largest number of deaths from the virus.

But will they apologise for that hand ball, will they buggery. That's all they'd need to do and I'd let it go, the cheating Argie b@stards.

German Grain Production Latest

Grain production estimates in Germany have been revised slightly higher by the association of German farm cooperatives (DRV), saying that a cool and wet May/June period has aided yields.

This means that the German grain harvest this season will total 47.8 MMT, they say, that's 400,000 MT more than their previous estimate although still 4.6% lower than last season's 50.1 MMT.

Wheat production has been revised upwards to 24.9 MMT, up 100,000 MT from previously, but still 4.25 lower than last season's 26.0 MMT.

Barley output will be 11.8 MMT they say, up 200,000 MT from their earlier estimate and now just 1.7% down on last season's 12.0 MMT.

Corn production will be 4.4 MMT (13.7% down on 5.1 MMT in 2008) and oilseed rape output 5.2 MMT (2% higher than last year's 5.1 MMT), they say.

German trading house Toepfer are a little more conservative, pegging the nation's grain crop at 46.5-47.5 MMT, of which wheat is estimated to be in the region of 24-25 MMT.

French analysts Strategie Grains pegged the German wheat crop at 24.5 MMT a fortnight ago, with barley coming in at 11.9 MMT.

Oil World recently said that German rapeseed production this year could reach a record 5.5 MMT.

EU Wheat Ends Mixed Thursday

EU wheat futures closed mixed Thursday with Paris November milling wheat closing EUR1.75 higher at EUR141.25/tonne, and London November feed wheat ending down GBP1.25 at GBP112/tonne.

Harvest pressure is coming from the US and eastern Europe, but farmers are reluctant sellers at this sort of money.

Across Europe weather conditions are mostly ideal for good crop development, although in areas like Bulgaria and Hungary it is too dry.

A weaker crude oil market also did little to help wheat's cause today.

CBOT Closing Comments

Soybeans

July soybeans settled 15 1/2 cents lower at $12.43 a bushel, and November soybeans finished 9 1/2 cents lower at $10.06. The weekly export sales from the USDA were pretty strong at 443,600 MT. In addition private exporters reported sales of 660,000 MT of soybeans for delivery to China during the 2009/10 marketing year, and and 152,400 MT sold to unknown. That is a seriously lot of kit, and seems to indicate that sales to China are far from finished.

Corn

July closed down 6 cents at $3.45 3/4 a bushel. sales today were a combined total of 1.27 MMT above the trade estimates of 550,000 to 850,000 MT. Today’s sales bring the total export sales to 1.3678 billion bushels approaching the USDA forecast of 1.9 billion bushels. Private exporters reported sales of 152,400 MT of corn for delivery to unknown destination for the 2009/10 marketing year.

Wheat

September wheat closed down 6 1/2 cents at $5.29 a bushel. Export sales were 241,860 MT below the low end of trade guesses. Variable rain amounts could postpone harvest in some areas over the next five days in the Southern Plains but will continue to be a challenge through July 7th to the 11th from Kansas north into the Dakotas with above normal rainfall predicted in those areas.

eCBOT Close, Early Call

The overnight session closed lower with beans down 24 1/2 cents nearby and 13-16 cents further forward. Wheat closed 2-3 cents lower and corn around 4-6 cents easier.

Beans and wheat both traded higher earlier in the session but lost ground late on as crude fell and the dollar rose.

Crude is down $1.66 at $67.65/barrel, European equities are also weaker and Wall Street is expected to follow suit.

Chicago is closed tomorrow for Independence Day so there will undoubtedly be an element of book-squaring going on this afternoon.

In the US a dry and warm forecast through until Saturday will be largely beneficial to corn and bean development.

The weekly export sales were bullish for corn and soybeans and neutral for wheat. In the beans, China took almost half the total, including more old crop. It looks like they are going to stick around a while yet.

South Korea bought one cargo - 55,000 MT - of US corn overnight. Japan booked 108,000 MT of mostly US wheat, Taiwan booked 82,350 MT of US wheat and Egypt last night booked 90,000 MT of US/French wheat.

Early calls for this afternoon's CBOT session: corn called 2 to 5 lower; soybeans called 10 to 15 lower; wheat called 3 to 5 lower.

USDA Weekly Export Sales/Shipments

Export Sales

For the period June 19-25, 2009 the USDA report weekly export sales as follows:

For soybeans old crop net sales were 193,500 MT were up noticeably from the previous week and from the prior 4-week average. You guessed it, China was the largest home taking 68,600 MT. For new crop we got net sales of 250,100 MT, of that the top two homes were? Can you guess? That's right, unknown destinations (125,000 MT) and China (120,000 MT). That gives us combined weekly sales of 443,600 MT against pre-report estimates of 125-400,000 MT.

For corn the USDA reported old crop net sales of 1,155,100 MT - up 68 percent from the previous week and 67 percent from the prior 4-week average. New crop net sales came in at 117,000 MT for a combined total of 1,272,100 MT, well above pre-report estimates of 550-850,000 MT.

For wheat of course we are already in the new crop marketing year, getting net sales of of 241,900 MT, against expectations of 250-350,000 MT.

Whilst the soybean sales were only just outside the range of estimates, I don't think that anyone expected old crop to make up almost half the total. And of course, yet again China are still here booking old crop as well as new crop. What are they doing? Turning their dollar reserves into commodities that's what. With $1.95 trillion of their foreign exchange reserves in US dollars, there's a fair bit still left to go at!

Corn sales were very strong yet again, with Japan, South Korea, Egypt and Taiwan all booking six figure quantities. I wouldn't mind the brokerage on that.

Wheat was, as wheat is, ho hum steady away.

Exports

On the actual shipped front, 387,100 MT of soybeans departed US shores last week, where were they headed? It begins with a C. They eat a lot of rice. No, not Colchester. I'm starting to feel a bit like Caroline Ahern on the Fast Show doing the Scorchio! sketch here. Yes our Far Eastern chums took 188,600 MT of soybeans last week, they probably didn't need them but they're better than dollars right now, especially with temperatures hitting 113 degrees F in the north of the country's soybean belt this week.

For corn, exports came in at 742,500 MT, mostly to Japan, Taiwan, South Korea, Mexico and Egypt.

Wheat exports were 366,700 MT. The primary destinations being Yemen (55,000 MT), South Korea (48,400 MT), Nigeria (39,000 MT), Indonesia (33,000 MT), Ecuador (32,000 MT), and Colombia (29,100 MT).

Germany To Open Second Generation Biofuel Plant In 2010

Germany could have a second generation biofuels plant up and running by 2010, according to a report on Reuters.

The plant, in Freiberg in southern Germany, will produce biomass-to-liquid (BTL) fuels largely using wood products and wood-based waste, with not a grain of wheat in sight.

Full story here: I've got wood

Argentine Situation Could Be Bullish Wheat But Bearish Soybeans

Defeat for the Kirchners in Sunday's mid term Argentine elections is being seen as a massive protest vote by your average Argentine. José Public now has a lower per capita income than his counterpart in neighbouring Chile.

“With all respect to our President, I hope you have heard the message of the Argentines in the polls and beginning tomorrow you will convene us to dialogue”, said the Mayor of the City of Buenos Aires, Mauricio Macri emerging from Sunday’s mid term election as one of the strongest 2011 presidential hopefuls.

The adverse results were not just limited to the province of Buenos Aires, or the poor showing in the city of Buenos Aires either, it also included defeat of the Kirchner candidates in three leading provinces, Córdoba, Santa Fé and Mendoza, and even in Patagonia’s Santa Cruz, the stronghold of the ruling couple.

The Kirchners might have dipped out in the mid term elections. but they're still in power, for now. The newly elected members of Congress will not take office until December, so uncertainty looms over how they will govern during the next five months.

Argentine farmers are continuing a silent protest by planting the smallest wheat crop in history. Production this year will do well to exceed 6 MMT, that's the level of national consumption, leaving nothing to line the Kirchner's export coffers.

Drought and taxes have also decimated the beef industry. Famously carnivorous Argentina, which was once the world's largest exporter of beef will also now have to import beef next year, perhaps several million tonnes, much of it coming from its tiny neighbour Uruguay.

The upshot of all this mayhem seems to be that Argentine farmers will sit on their hands for the next few months, before planting the largest soybean crop in their history.

Once wheat planting is out of the way, they don't begin planting corn and sunflowers until September, followed by soybeans in November/December. Already there is talk of a 20% increase in soybean plantings from 2008/09, and remember that they were talking a crop of 50 MMT before the drought set in. That could give us production next year of 60 MMT, almost double what they've just harvested.

All this of course is very weather dependent, but note that the 'likely' El Nino event being talked about might bring drought and misery for Australia later this year, but could potentially bring plentiful rainfall to Argentina.

Oklahoma Wheat Crop 'Worst In Decades'

Oklahoma’s wheat crop for 2009, coming after a barrage of droughts, freezes and heavy rains, is turning out to be what one farmer called the worst in the state since 1955.

Farmers in northern Oklahoma wrapped up harvests this week and some farmers in the Panhandle are still cutting grain, but few are happy with the yields.

A heavy freeze in early April finished off most of the crop in southwestern Oklahoma and badly damaged acreage in the state’s midsection. In addition to that, many parts of Oklahoma received heavy rains in April and May.

“We’re probably going to get less than half the wheat this year as last,” said Mike Schulte, the executive director of the Oklahoma Wheat Commission. “It was a tough year to be growing.”

Bulgarian Crops Hurting

Grain crops in Bulgaria are hurting from drought and heat stress, according to the Dobrudzha Agriculture Institute.

Yields this year will be 20-25% lower than in 2008 they say.

Yields in the northeast, which has the most fertile soil in Bulgaria, will struggle to reach the usual 500 kg of wheat per decare, they say.

The Institute expects about 400-500 kg of barley per decare in the northeast, and about 200-300 kg in Southern Bulgaria.

The amount of rain in Northeast Bulgaria in the spring thus far had been only 15 litres per square metre which was very insufficient, they noted.

Crude Oil Drops Despite Stocks Data

Crude oil fell late yesterday, and has followed through lower this morning despite figures from the US Energy Information Administration saying that US inventories fell 3.7 million barrels last week. That's more than the 1.5-2.0 million that the market had been expecting, and the fourth weekly drop in a row.

The market instead chose to focus on rising gasoline and distillates stocks instead, which rose by 2.3 and 2.9 million barrels respectively.

A firmer dollar is also hurting crude this morning, which currently stands $1.06 lower at $68.25/barrel.

The USDA: Lying Or Just Plain Incompetent?

Another thing that struck me on Tuesday, as I continue to pick through the small print of the USDA report, was the surprise increase in wheat acres.

An extra 1.137 million of them suddenly appeared from nowhere.

Of that total almost half a million were spring wheat acres, now that's a surprise isn't it because spring wheat plantings, particularly in the top producing state of North Dakota were famously running well behind weren't they?

In the March report, 13.304 million acres of spring wheat would be planted the USDA told us, now they say it's 13.772 million.

Now remember here that spring wheat is normally planted April/May, it is generally accepted that planting after May 31st is not a sensible thing to do. Also, May 31st is the cut-off date for claiming full crop insurance on any wheat that subsequently fails. In addition new crop beans and corn at the time offered some pretty fruity returns, so planting them instead was a distinctly viable alternative.

If we check back to 31st May we find that the USDA were reporting spring wheat plantings at just 89% complete. A week later they said 96% done. There are no more planting progress reports for spring wheat after the 7th June as it's pretty much assumed that if it's not in then it won't get planted.

Yet now we have the USDA telling us that not only did the last remaining 4% get planted well outside the normal planting period, but US farmers threw in another 468,000 acres on top of that just for good measure!

Additionally, these spring acres are only part of the picture, there's another 669,000 on top of that which was newly found this week. Where did they come from? The answer is 559,000 winter wheat and 110,000 durum wheat.

This stuff gets planted around September/October, why didn't they know it was there in March?

Discuss.

EU Raises Import Duties On Maize And Sorghum

The European Commission have raised the import duties on maize and sorghum for the year ahead.

The duty on maize will increase from EUR12.22/mt to EUR17.34/mt, and the duty on sorghum from EUR45.92/mt to EUR47.89/mt.

The import duties for wheat and barley remain unchanged.

Hopefully that might mean a bit more wheat getting used domestically by the feed trade.

Russia Exports Record 23 MMT Grain In 2008/09

Russia has been an aggressive exporter on the world market this past year after bringing in it’s largest wheat crop in post-Soviet history. A crop of 63.7 MMT in 2008 propelled the country to export a record amount of grain in the 2008/09 (July/June) agricultural year.

Russia exported a record 23 MMT of grain during the 2008/09 marketing year just ended, according to the Agriculture Ministry. Of that total 18 MMT was wheat, making Russia into the world’s third largest wheat exporter after the US and EU-27.

That amount comfortably exceeded Russia's previous grain exports record, which was reached in the 2002-2003 agricultural year when the country exported 15.8 MMT of grain.

For 2009 Russian wheat production is seen at 58 MMT according to the IGC, that’s almost 9% down on last season. Private Russian analysts SovEcon peg the crop closer to 60 MMT.

Despite a drop in production, Russia is likely to remain an aggressive exporter in 2009/10, with the USDA currently predicting exports of wheat steady at 18 MMT.

CBOT Closing Comments

Soybeans

July soybeans closed at $12.58 ½, up 32 ¼ cents, November beans finished at $10.15 ½, up 34 ½ cents. This still looks like a game of two halves to me. Old crop is tight and could do anything, especially if China continues to confound the market and spot buy. There is definitely potential for (lack of) supplies across the next couple of months to spike spot prices sharply higher. Beyond that though I wouldn't touch beans with a bargepole. New crop supply potential is enormous, and also South America will weigh in with a huge crop in the spring, unless Mother Nature sticks her oar in again. Soybean export sales estimates for Thursday’s report range from 125-400,000 MT.

Corn

July corn closed at $3.51 ¾, up 4 cents, December corn at $3.69 ¼, up 2 cents. After last night's sharp falls the market took stock today. US weather remains conducive for a very nice crop this year, but spillover strength from beans added a bit of support. As with soybeans, the longer term fundamentals look bearish for corn. Corn export sales estimates for tomorrow’s report range from 550-850,000 MT.

Wheat

July CBOT wheat closed at $5.06 ¼, down 5 cents. Seasonal harvest pressure and the USDA surprisingly finding another 1 million acres of wheat in yesterday's report weigh on the market. Wheat export sales guesses range from 250-350,000 MT for tomorrow’s USDA report.

EU Wheat Recovers Slightly Wednesday

EU wheat futures recovered somewhat from a complete mauling Wednesday, with Paris November milling wheat closing unchanged at EUR139.50/tonne, and London November feed wheat ending up GBP0.75 at GBP113.25/tonne.

Prices look like they well overdone on the downside Tuesday after a massively bearish USDA report, and corrected a little today.

The validity of the USDA figures is certainly being questioned in some quarters, exactly how they could find one million more wheat acres from their March prediction is certainly open to debate.

Still, harvest pressure seems set to keep a lid on any potential rallies at the moment

Egypt's GASC bought 90,000 MT of wheat in a tender today, again passing on Russian wheat to book French and US material.

That news may provide a little support tomorrow.

Argentine Wheat Area Lowered Again - Exchange

The Buenos Aires Cereals Exchange lowered it's estimate of the total wheat planted area for the 2009/10 crop once again Wednesday, this time cutting it to 2.8 million hectares.

So far only 1.37 million hectares have been planted it said, leaving farmers needing to double their plantings to meet that target with only four weeks left to go of the normal planting season which began at the beginning of May.

That looks like a pretty tall order.

When you consider that they only got 2 MT/ha last year, even if they do manage to get it all in the ground then a crop of only 6 MMT, maybe less, looks likely unless rains arrive.

The soybean harvest is now complete and will total just 32 MMT the Exchange said, that's a far cry from early season expectations of a crop of 50 MMT.

eCBOT Close, Early Call

The overnight eCBOT trading session is now extended to trade until 13.15 BST, not a 12 noon close.

Beans closed sharply higher, around 20 cents up, with wheat around 8 cents higher and even corn manging to post modest 4 cent gains.

Late strength in beans from last night's main CBOT session spilled over into the overnights with traders seeming to view yesterday's early wobble as a buying opportunity.

Soybeans were the only thing that didn't throw up a bearish surprise as far as plantings were concerned, rising around half a million less than analyst's estimations. Still, quarterly ending stocks were a little higher than trade ideas.

Even so, if we can piece together a bullish argument for beans it has to be based around old-crop tightness, maybe spilling over into the early new-crop months on the probability of a late harvest.

The large increase in corn acres was a shocker and futures closed at or around limit down last night. Crop reports generally seem to indicate that US corn is looking in great shape. It's hard to whip up too much enthusiasm for going long right now.

Wheat is a more interesting proposition, despite surprisingly raising the acres the USDA also said that only 80% of the winter wheat crop planted would actually get harvested.

Sharply lower production from Argentina may not yet be fully factored into this market. The USDA still have a figure of 11 MMT for 2009/10 and 4 MMT being exported. Both those numbers look massively overestimated.

Harvest pressure from the US, and shortly from Europe isn't going to see wheat stage some sudden huge bull anytime soon run mind you.

Crude oil is higher after the API dropped it's stocks estimate by a large 6.8 million barrels last night. The US Energy Dept are out with their estimate at 15.30 BST, that is expected to show a more modest fall of around 1.5 million barrels.

The dollar is a bit weaker, and equities a little firmer.

Early calls for this afternoon's CBOT session: corn called 2 to 4 higher; soybeans called 15 to 20 higher; wheat called 5 to 10 higher.

World Wheat: Thinking Outside The Box

The world is awash with wheat and stocks are forecast to get even higher next season. That's what everybody is telling us.

Our chums at the USDA say that global wheat stocks will have recovered from a low 120 MMT in 2007/08 to 168 MMT this season and 183 MMT by the end of 2009/10. (The IGC peg next season's ending stocks somewhat lower at 168 MMT, but let's run with the USDA numbers for now).

Who is holding these stocks is an interesting question. Dig a little deeper and the stocks figures aren't as bearish as it might appear at first glance.

A few key exporting countries (like the United States, EU, Canada, and Australia) are surplus producers who consistently supply the world and hold carryover stocks available to the market. History has demonstrated that there is a strong inverse relationship between global prices and the reserves held by these countries, say the USDA themselves.

Meanwhile reserves held by countries like China and India rarely come onto the export market.

Global Wheat Ending Stocks (in MMT):

2007/08 2008/09 2009/10

Australia 4.687 5.462 5.987

Canada 4.561 7.531 6.531

China 38.963 48.413 59.713

EU-27 12.414 20.482 17.443

India 5.800 13.910 16.910

Iran 3.157 4.507 6.057

Russia 1.819 8.969 10.269

US 8.323 18.217 17.610

Others 40.241 40.906 42.130

---------------------------------------------------

Total 119.965 168.397 182.650

---------------------------------------------------

You will note that much of the increased stocks in 2009/10 come from traditionally non-exporting nations such as China, India and Iran. If we reproduce the table without those three we get this:

2007/08 2008/09 2009/10

Australia 4.687 5.462 5.987

Canada 4.561 7.531 6.531

EU-27 12.414 20.482 17.443

Russia 1.819 8.969 10.269

US 8.323 18.217 17.610

Others 40.241 40.906 42.130

---------------------------------------------------

Total 72.045 101.567 99.97

---------------------------------------------------

Add to that the possibility that the IGC are correct and that the USDA estimates for 2009/10 are 14-15 MMT overstated, and that maybe throws a different complexion on things.

Note that the world's top six exporting nations will account for around 82% of all global wheat trade in 2008/09, according to the USDA. Production in these is:

2008/09 2009/10

EU-27 151.7 132.6

US 68.0 57.0

Russia 63.7 59.0

Canada 28.6 23.6

Australia 21.5 22.0

Ukraine 25.9 18.0

--------------------------------------

Total 359.4 312.2

--------------------------------------

So the world’s top six exporters are set to produce around 47 MMT, or 13%, less wheat in 2009/10. Meanwhile, the world’s seventh top exporter in 2008/09, Argentina, is set to produce so little wheat and with negligible carry-in stocks after back-to-back droughts that it probably won’t have anything to export at all.

These are the countries that count, China can hold all the wheat it likes without it affecting the global market one jot if it's neither a buyer or a seller. If you want to buy wheat this is where you go to shop, and stocks and production amongst the main players isn't rising in 2009/10, it's falling.

Jordan Buys, Japan Seeks Barley

Jordan has bought 100,000 MT of Ukrainian barley at USD168 C&F from the Ukraine trading house Nibulon, according to media reports.

The barley will be delivered 50,000 MT first half August and 50,000 MT first half September.

Japan meanwhile is tendering for 200,000 MT of feed barley for July/October delivery, according to it's Agricultural Ministry.

USDA Report - The Small Print

In amongst the bombardment of activity following the volume of data thrust at us by the USDA yesterday, and the incredulous nature of some of it, it may take a day or two to sift through it all and put it into some sort of order.

One statistic that's sprung to my notice this morning concerns the winter wheat area.

Winter wheat accounts for around three quarters of the total US wheat area, including durum, coming in at 43.448 million acres of a total area of 59.775 million.

Typically, a fairly hefty chunk of this never actually sees a combine, and is often abandoned for grazing or ripped up and replanted with something else, depending on how the crop develops.

Last year only 86% of the planted winter wheat area actually got harvested as grain.

This year the USDA see that figure dropping to 80% after the wide scale failure of crops in states like Texas and Oklahoma.

That means that the actual production numbers may not be quite as bearish as the bare acreage figure suggests when they come out with their revised Supply & Demand estimates later this month.

Egypt's GASC Tendering For Wheat

Egypt's state wheat buyer GASC is back in the market tendering for wheat today, saying that it is seeking 'at least' 55,000 MT.

Last week Egypt bought it's first wheat since the end of April, buying 60,000 MT of French wheat at $191.44/tonne FOB.

The price was said to be around $7/tonne dearer than Russian wheat offers, which would also have benefited from cheaper freight.

Will they continue to snub Russian wheat, despite apparently reaching an accord over recent quality issues?

El Nino Weather Event 'Likely'

The Australian Bureau of Meteorology say that more evidence of a developing El Niño event has emerged during the past fortnight, and computer forecasts show there's very little chance of the development stalling or reversing.

El Niño events are usually (but not always) associated with below normal rainfall in the second half of the year across large parts of southern and inland eastern Australia, they say.

El Niño occurs when sea surface temperatures warm up in the central equatorial Pacific Ocean, Really severe damage occurred in recent El Niño cases in 2002 and 2006 when less than half a normal wheat crop was harvested.

Crude Oil Leaps As Stocks Fall Sharply

Crude oil was higher in early trade Wednesday morning, after the American Petroleum Institute said crude supplies fell a whopping 6.8 million barrels to 349.7 million last week.

That's the largest decline in US inventories in more than nine months.

Yesterday, crude briefly popped above $73/barrel for a eight month high, before falling back after data showing a decline in US consumer confidence, to settle at $69.89/barrel.

At 9am London time crude was $1.17 higher at $71.06/barrel.

The US Energy Department will report their stocks data later this afternoon.

CBOT Closing Comments

Soybeans

July soybeans closed at $12.26 ¼, up 11 ¼ cents, November soybeans at $9.81, down 2 ½ cents. The USDA numbers were actually modestly bullish for beans, but overwhelmingly bearish for corn and a bit more modestly do for wheat. Corn finished sharply lower dragging everything else down with it. The old-crop picture for beans remains quite bullish with the distinct possibility of further technical squeezing yet to come. For new-crop however I think I'd have to say I'd rather sell it than buy it.

Corn

July corn closed at $3.47 ¾, down 29 ¼ cents and December at $3.67 ¼, down 30 cents, closing limit down on the first three months of new crop. The USDA acreage number shocked the trade, coming in a million acres higher than the highest trade estimate, and two and a half million above the average trade guess. With acreage numbers like this, the USDA can be expected to raise ending stocks in their July report too. Weather conditions remain pretty conducive for rapid crop development over the next week or so.

Wheat

July CBOT wheat finished at $5.11 ¼, down 17 ¼ cents. All wheat planted acres were increased by around a million, which potentially increases ending stock in next month's Supply & Demand report. Winter wheat harvesting is progressing well, with hot and dry weather enabling rapid advancement. Any bullish news is out of the window, the bears are in the driving seat for the time being. Japan is expected to buy 108,000 MT of mostly US wheat in a routine tender Thursday.

EU Wheat Ends Sharply Lower On Bearish US Data

EU wheat futures closed sharply lower Tuesday after the USDA released an almost unbelievable set of bearish planting data, sending US futures crashing lower.

Paris November milling wheat closed down EUR4.25 at EUR139.50/tonne, and London November feed wheat closed down GBP3 at GBP112.50/tonne.

The USDA June acreage report stunned the market by increasing planting estimates for corn, wheat and soybeans from their previous forecasts in March.

Exactly how they can manage to find around a million acres more wheat, one and a half million more soybeans AND two million more corn seems questionable, but find them they did.

In London November feed wheat opened GBP1/tonne higher but crashed as much as GBP5/tonne lower in the aftermath of the USDA figures.

The US harvest is progressing well, with expectations that it will all but wrapped up in Oklahoma by the weekend, and move from southern Kansas into the northern half of the state.

Harvest pressure is on the cards for Europe too, with barley cutting in Germany expected to begin this weekend.

Still, I guess it should come as no major surprise that we see the market down at this time of year. Even so the magnitude of the drop witnessed during one month is severe.

In London November feed wheat hit GBP134/tonne on June 1st, and has set a monthly low of GBP110.50/tonne today, making for a drop of 17.5% or GBP23.50/tonne in just over four weeks.

A pretty impressive slump by any standards.

Do The USDA Know What They Are Doing?

It has to be open to question. They've just found a million more wheat acres, one and a half million more soybean acres AND two million more corn acres than they had in March. No losses just gains all round.

And if they do know what they are doing, then how do you explain their March estimates?

This is the same USDA we are talking about here who left Argy 2009/10 wheat production unchanged this month at 11 MMT, around a 30% increase in output on last year from around 30% fewer acres, in the midst of eighteen months of severe drought.

The same USDA whose global wheat ending stocks figure for 2009/10 is almost 15 MMT higher than that of the International Grains Council.

They are either a darn sight cleverer than Allendale, Informa and all the rest put together or there's another explanation.

I'll leave you to make your own minds up.

CBOT Call: Corn Sharply Lower

The USDA report has got to be hugely bearish corn, bearish wheat, and mildly friendly to beans, but it's difficult to imagine beans managing to swim against the tide, certainly for new-crop.

Could we be in for a quick knee-jerk reaction crash in the first hour or so of trade, followed swiftly by a "nah, the USDA are talking sh1t" reversal? We've seen that happen before, but in the wake of a massive global recession??

Official calls are around 10-20 down on corn, 10 down on wheat and 5 up on beans.

I think well see corn heavily down soon after the opening, with wheat down there with it for company and beans also dragged into negative territory.

Where it will end tonight is anybodies guess. Mine is limit down corn & wheat, beans 5-10 down old crop and 10-20 down on new crop.

USDA Stocks Report

The USDA quarterly stocks report:

June USDA Avg Trade Range March 2008

------------------------------------------------------------------

Corn 4.266 4.190 4.064-4.321 6.958 4.028

Soybeans 0.597 0.586 0.559-0.620 1.302 0.676

Wheat 0.667 0.670 0.640-0.687 1.037 0.306

USDA Acreage Report: Well We Expected A Surprise

We certainly got one. Hot off the press, here are the magic numbers:

June USDA Avg Trade Range Mar USDA 2008

-----------------------------------------------------------------

Corn 87.035 84.158 82.474-86.000 84.986 85.982

Soybeans 77.483 78.305 75.300-79.631 76.024 75.718

Spring Wheat 13.772 13.102 12.826-13.404 13.304 14.135

All Wheat 59.775 58.337 57.600-58.800 58.638 63.147

Whooooa there, where the hell did all those extra corn acres come from? Three million more than the average trade guess and an increase of two million on the March estimate, are you twisting my melons?

The bean acres, not a problem, 77 1/2 million, fine I can buy that. Spring wheat more acres than March? All wheat a million more acres than March, and a million over the highest trade estimate?

Who compiled these Bernie Madoff?

eCBOT Close

The overnight eCBOT session closed with nearby July beans remaining the star of the show, 10 1/2 cents higher at $12.25 1/2. Further forward months closed with more modest gains as the trade readies itself for what it perceives to be a bearish new-crop USDA report.

Corn and wheat closed 3-4 cents higher. Corn was supported by ideas that the USDA will cut it's planted area to 84.158 million acres from 84.986 million in March and 85.982 million in 2008. Wheat benefited from ideas that spring acres will be trimmed and short-covering.

Last night's planting progress report shows that 4% of intended soybean acreage remains unplanted. The same report had the winter wheat harvest at 40% compared to 46% on the five year average. Spring wheat crop conditions good/excellent fell one point and poor/very poor increased one point.

Crude oil was higher throughout most of the session, but has just eased off a little in the last hour. More militant strikes on pipelines in Nigeria being supportive.

The Dow closed 90.99 points higher Monday and is expected to continue in that vein at the opening today. European stocks are also mostly a little higher.

Now we are sitting tight waiting for the USDA at 13.30 BST. A quick recap of what is expected:

US soybean acreage is estimated at 78.305 million and ending stocks are forecast at 585 million bushels.

Traders are looking for corn acres to come in at 84.158 million, with quarterly ending stocks at 4.19 billion bushels.

All wheat acreage is estimated at 58.337 million, spring wheat is pegged at 13.102 million, and quarterly ending stocks at 670 million bushels.

Well, That Didn't Last Long Did It

The pound enjoyed a brief half an hour or so of relative euphoria this morning, hitting an eight month high of $1.6746 against the dollar on bullish talk of risk appetite and increasing UK house prices.

But the final reading of first quarter GDP showing the lowest quarterly growth since 1958 of -2.4% down from -1.9% - quickly put paid to all of that.

By noon the pound was back under the cosh, falling to $1.6585 against the dollar and 1.1740 against the euro from an earlier high of 1.1849.

The notion that we are seeing the pound become overvalued is backed by the weak growth numbers including a 1.3% drop in household spending and exports falling for a fourth quarter by 6.9%.

'Contaminated' Soymeal Threatens EU Trade

The discovery of traces of unathorized variety of genetically modified maize in a batch of soymeal in Germany is threatening to bring EU trade in soymeal to a standstill.

Traces of the prohibited GM variety MON88017 were found in soymeal processed in Germany from US soybeans.

The discovery throws open once again the whole debate on the EU's existing zero-tolerance policy to GM varieties in food and feed.

A letter to the EU Commission, signed by many of the EU food and feed trade bodies such as Coceral and FEFAC says:

"The cross contamination of the soybeans with MON88017 was due, in all likelihood, to dust prevalent in the transport and handling chain. This clearly demonstrates that, despite all precautions taken by the operators, it is not possible to guarantee 100% purity. Therefore, cross-contamination as notified by the German authorities can re-occur at any time leaving the whole chain at risk."

The letter goes on to say:

"Although the genetically modified maize in question has been assessed safe for both feed and food uses trace amounts could force operators to stop imports of soybeans completely."

Fait accompli?

Everything's Rosy Isn't It?

Andy Murray wins a nail-biter, the pound leaps to it's highest since October against the dollar, and close to it's highest against the euro since late-2008, house prices are finally rising.

We're on our way, what could possibly go wrong?

"Our public finances are easily the worst we’ve ever had in peacetime," says former chancellor Nigel Lawson. And that boy knows a thing or two about debt.

The problem is Gordon McBroon is a stubborn old bastard clinging desperately to the sinking ship, eagerly pouncing on the slightest snippet of positive news as clear proof that he's getting us back afloat.

He's waited a long time to become PM and he's going to see the thing right through until the death. The question is how bad will things be when he's finally evicted from No 10? The kind of action that he should be taking, like cutting public spending and raising taxes to tackle the UK's fiscal deficit would make his popularity at the polls fall even further.

So instead he continues to splash around, reassuring us that he's on top of the job, that we aren't sinking really we're just sailing through a bit of a squall.

The Deluded One has another twelve months before he has to call an election yet, we could be stuck with another year of vacuous inaction until then.

Harvesting Underway In Ukraine

The combines are rolling in Ukraine, with 1 MMT of grain already cut, according to the president of Ukrainian agrarian confederation.

This season's grain harvest will total 39 MMT he says, almost 27% lower than the 53.3 MMT produced last season.

That estimate is a few million tonnes shy of the official Ministry forecast of 42-43 MMT.

The wheat harvest will come in at 18 MMT, according to the IGC, more than 30% down on a year ago when production was 25.9 MMT, meaning that the country will export 21% less this season at 7.75 MMT, according to UkrAgroConsult.

UkrAgroConsult peg barley production at 10.0 MMT, 19% down on last year's 12.3 MMT. Early reports suggest that yields are down as much as 30-40% in places on unfavourable weather in the past three months.

Rapeseed production in the Ukraine is seen down 48% this year to 1.5 MMT, from 2.9 MMT in 2008/09 according to Oil World.

Pound Jumps On Housing Data

The pound jumped as high as $1.6740 against the dollar, it's highest level since 21st October, on bullish housing data.

UK house prices rose 0.9% m/m in June, another surprising rise following on from May's 1.3% increase, sparking the inevitable recovery talk.

The year on year reading improved to -9.3% from -11.3%, so house prices are still down on a year ago, but not by quite as much.

Before we all get too carried away, it is also worth considering that the data is now based on a far smaller number of transactions than that of a year ago, so there is a possibility that the bare numbers are distorted slightly.

Against the euro the pound stands close to it's recent highest levels since December.

USDA Crop Condition Report

Corn

The crop progress report was out this afternoon. 7% of the corn crop is rated poor to very poor and 72% good to excellent, a 2% improvement in the good to excellent category from last week. The trade was looking for a 2% decline in the good to excellent category.

Soybeans

Soybeans are 96% planted compared to the five year average of 98%. The soybean’s condition rating was 6% poor to very poor and 68% good to excellent, a 1% improvement in the good to excellent rating. USDA shows 91% of the soybeans emerged, close to the 5 year average of 95%.

Wheat

The report has the wheat harvest at 40% compared to 46% on the five year average. Texas is 70% harvested, Oklahoma 89% harvested, Kansas 47% and Missouri 58% harvested. The winter wheat crop is rated 28% poor to very poor and 45% good to excellent, unchanged in the categories but a 1% shift from good to excellent compared to last week. Spring wheat is rated 6% poor to very poor and 76% good to excellent, an increase of 1% in the P/VP and a 1% decrease in the G/EX.

CBOT Closing Comments

Soybeans

Beans closed mixed with July at $12.15, up 14 cents and November at $9.83 ½, down 7 ½ cents. The old crop scenario remains tight and the new crop one bearish, or at least so we think until tomorrow. US acreage is estimated at 78.305 on average for the USDA planted acres report and ending stocks are forecaste at 0.585 billion bushels with a range of 0.560 to 0.620 billion bushels. Some reports are circulating however that the planted area will actually drop from the 76.024 estimated in March. Tomorrow will be interesting.

Corn

July corn finished at $3.77, down 7 ¼ cents. The USDA acreage and quarterly grain stocks report will be released tomorrow at 13.30 BST. Traders are looking for corn acres to come in at 84.158 million acres on average. Quarterly ending stocks are forecasted to average 4.19 billion bushels with a range of 4.064 to 4.321 billion bushels. US weather remains conducive for good crop development for the time being.

Wheat

July CBOT wheat closed at $5.28 ½, down 5 ¾ cents. All wheat acreage is estimated at 58.337 million on average by the trade industry for tomorrow’s USDA planted acreage report. Spring wheat is pegged at 13.102 million acres, down from 13.304 million in March. The trade estimates wheat quarterly ending stocks at 0.670 billing bushels with a range of 0.640 to 0.687. Meanwhile the Argentine crop keeps shrinking and could fall to just 6 MMT this year say the Buenos Aires Grain Exchange, almost half of the current USDA prediction.

EU Wheat Ends Higher Despite Impending Harvest

EU wheat futures closed higher Monday, despite the impending wheat harvest. With futures having fallen 20% or more since the start of the month a technical correction was well overdue.

Paris November milling wheat futures closed up EUR2.25 at EUR143.75/tonne, and London November feed wheat ended up GBP1.75 at GBP115.50/tonne.

The USDA acreage report tomorrow maybe also encouraged some short sellers to book profits, although the wheat numbers are less likely to throw up a surprise than those for corn or soybeans.

Funds are heavily short US wheat however, leaving the market vulnerable to a corrective move.

In Germany the barley harvest got underway over the weekend, and in France wheat is expected to begin getting cut within the next week or so. Despite that though farmers are reluctant sellers at these levels, and there is still a large carry premium on offer.

Warm and dry weather across much of Europe may lead to some better quality wheat being around this coming season.

eCBOT Close, Early Call

The overnights closed mixed with corn 1-2 cents lower and wheat around 4 cents higher. Beans closed around 3-5 cents firmer on old crop and mostly just a cent or so higher on new crop.

Trading today is likely to centre around book-squaring ahead of tomorrow's USDA reports. Funds are short wheat, so there may some buying there as they look to book profits.

The jury is still out on tomorrow's acreage report from the USDA, with some forecasting a surprise drop in planted area for soybeans, contrary to the 2 million or so increase that most have pencilled in.

That would likely mean more corn acres than the average trade guess. For wheat only a modest downwards revision in spring area is anticipated.

The Argentine wheat crop for 2009 has a large question mark hanging over it, the USDA currently have a crop of 11 MMT from 4 million hectares, yet the Buenos Aires Grain Exchange said at the weekend that final production could be down to 6 MMT this year.

It is worth noting that the USDA's global wheat ending stocks figure for 2009/10 is 14 MMT higher than last week's IGC estimate at 182.65 MMT.

Argy president Fernandez appears to have lost control of both houses of congress in mid-term elections.

Crude oil is higher, bubbling just under the $70/barrel mark and the dollar is a fraction higher, whilst Wall Street is expected to open a little firmer too.

Early calls for this afternoon's CBOT session: corn called flat to 2 lower; July soybeans called 4 to 6 higher, November 1 to 2 higher; CBOT wheat called 2 to 4 higher.

Argy Midterm Elections Latest

Congressional candidate Francisco de Narváez is just leading in Buenos Aires province ahead of ex-president Néstor Kirchner, in a high-profile race in the country's mid-term elections, early official results showed.

With 36 percent of the vote counted, De Narváez's Unión-PRO party is ahead with 34.78 percent of the ballot, and Kirchner's Justicialist Victory Front in second with 32.78 percent.

The results that are in so far would mean that the government will lose its majority in both houses of congress.

The key race is in Buenos Aires province, home to 38 percent of Argentines, where dueling Peronist factions are scrambling for the largest share of the 35 lower house seats up for grabs in that district alone.

A win for De Narváez would be popular with Argentine farmers as he is seen as being more sympathetic to the farmers' cause, owning an agriculture company himself, and being a close associate of the Kirchner administration's former Agriculture Secretary Felipe Sola. Sola quit his post last year in protest over the government's handling of the long-running dispute with the farmers.

Milk Link Offer To Take On Remaining DFoB Members Without A Contract

Milk Link have offered to take on the remaining 143 former Dairy Farmers of Britain members who have yet to find an alternative outlet for their milk, and are currently selling it to receivers PricewaterhouseCoopers at 10ppl.

Milk Link have offered to pay the farmers involved 18ppl for a trial three month period.

Milk Link, who acquired the DFB-owned Llandyrnog Creamery earlier this month, say that they can offer a better price due to their improved efficiencies and a larger milk field.

“The provision of this contract, we believe, will provide those DFB farmers without an alternative buyer, a much needed period of stability and a secure outlet for their milk. It will also allow them time to assess how they want to move forward in dairy farming,” said Milk Link.

Well done Milk Link I say. I guess that the bulk of the 143 are small-scale producers, some in rather remote and inaccessible places or they'd have secured an alternative outlet by now. I don't suppose that Lord Granchester is one of them.

Could The USDA Have A Surprise In Store?

Tomorrow's USDA report is expected to show US soybean acres rising to 78.3 million according to the average trade guess, that's 2.3 million more than their original March estimate.

But the report could throw up a surprise according to Lanworth Inc., a company that uses satellite imagery to predict plantings.

Never heard of them? I hadn't until around a year or two ago, when I remember them coming out with what, at the time, seemed like a totally off-the-wall forecast for soybean plantings that went contrary to what the vast majority of the trade were predicting.

Subsequently, as I recall, their forecast was proven to be pretty much spot on, totally against what the usual suspects were saying.

They base their estimates on images and ground data for the top thirteen producing US soybean states which make up 80% of the nation's production.

For this season, Lanworth are predicting a US soybean area of 75.75 million hectares, a quarter of a million fall from the March report.

They're not a lone voice in the wilderness, the range of trade estimates covers a fairly wide area starting at 75.3 million, so somebody is also thinking along the same lines as Lanworth.

That someone is Alaron, the wholesale switch to soybeans "would mean tossing out expensive corn seed and fertilizers and repurchasing bean supplies. Not likely," tney say.

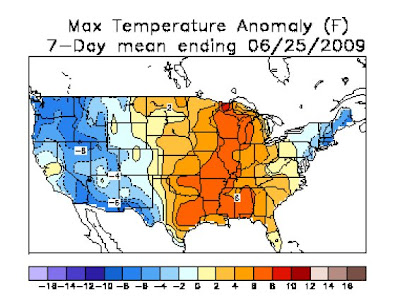

Some Like It Hot

Heat is the name of the game at the moment, with crops around the world at risk from excessive warmth.

Central China corn and bean belts recorded early heat of 113 degrees F last week, says Allen Motew of QT weather:

Meanwhile, in the US Midwest temperatures hit 100-107 F. As June leaves on a cooler note, the threat of heat and dryness returning for July and August is real, in contrast to the” timely rains and near-perfect” growing conditions of last summer, he says.

A cool-down will occur this week for the Corn Belt, centered in Michigan. The Delta and South will see normal to above next week before intense heat returns in early July. Intense heat, the second week of July, will put new stresses on early pollination and flowering corn and beans from Minnesota to Tennessee, he adds.

In the FSU, Ukraine to W Kazakhstan had abnormal heat too, being 2 to greater than 5 degrees C above the norm.

The slow to develop Indian monsoon also left India hotter than normal and too dry, he concludes.

USDA Acreage Report Expectations

Tomorrow at 13.30 BST we get the release of the USDA's June US acreage report, here's a summary of what is expected in million acres:

Avg Range March 2008

Corn 84.158 82.474-86.000 84.986 85.982

Soybeans 78.305 75.300-79.631 76.024 75.718

Spring Wheat 13.102 12.826-13.404 13.304 14.135

All Wheat 58.337 57.600-58.800 58.638 63.147

Interesting that some are forecasting an increase in corn acres to as high as 86 million.

Nogger's estimates: corn 84 million, beans 77.5 million, spring wheat 13 million, all wheat 58 million.

Argentine Wheat Crop May Fall To 6MMT - Exchange

The Argentine wheat crop may fall to 6 MMT this year, from 8.3 MMT last season say the Buenos Aires Grain Exchange, according to a report on Bloomberg (here).

That would be a huge reduction of almost two-thirds the production of just a couple of years ago, and potentially relegate Argentina to the role of a bit-part in international wheat trade in 2009/10.

And even this estimate looks ambitious.

Two thirds of the way through the optimal planting window of May/July, Argentine farmers had got just 923,000 hectares of wheat into the ground, according to the Exchange last week.

Yields last season averaged just 2 MT/hectare, even in the bumper year of 2007/08 they only managed 2.92 MT/hectare.

Jacko Fit and Well - USDA

The USDA report that Michael Jackson is fit and well and will probably live to a ripe old age. Jacko's chances of reaching octogenarian level are now rated 65% good/excellent, three points up on last week, after favourable rains fell near his Neverlands ranch last week.

Argentina will have a wheat crop of 11 MMT this year, and export 4 MMT they went on to say in this month's World Grain Markets and Trade report.