CBOT Closing Comments

Corn

December corn futures settled at $3.62 ¼, down 1 ¾ cents. The USDA forecast the US 2009 corn crop at the second highest in history at 13.018 billion bushels with an average yield of 164.2 bu/acre. That was higher than the average trade guess of 12.99 billion and 162.7 bu/acre. Corn 2009/10 ending stocks were in line with expectations at 1.672 billion bushels. Chinese production was lowered 5 MMT to 155 MMT, dropping global ending stocks almost 3 MMT to 136.3 MMT. Snow and freeing temperatures are in the forecast for the weekend, which will further hinder harvesting efforts.

Soybeans

November soybean futures finished at $9.64, up 28 cents, October soymeal futures finished at $310.30, up $7.60, October soy oil finished at 34.91 cents, up 63 points. It seems strange that the highest crop production estimate in history was bullish, but that's the way the trade seems to be reading it. The soybean numbers from the USDA were a little below pre-report estimates at 3.25 billion bushels, with a yield of 42.4 bu/acre. The average trade guess was 3.291 and 42.9 bu/acre. Ending stocks were reported at 230 million bushels, also lower than the average trade estimate. A higher US dollar index pressured futures, but higher crude oil and freeing weekend weather forecasts lent support.

Wheat

December wheat futures closed at $4.68, down 6 cents. Wheat ending stocks at 864 million bushels were well above the average trade estimate of 802 million. Global production was raised almost 5 MMT to 668.15 MMT, although an increase in consumption only saw world ending stocks increased slightly to 186.73 MMT, from 186.61 MMT last month. Production increases came from Canada (2 MMT), Russia and the US (1 MMT each), and the EU-27, Kazakhstan and Australia all raised by around half a million each.

EU Wheat Ends Unchanged To Lower After USDA Numbers

EU wheat futures closed flat to slightly lower Friday in the aftermath to the USDA's October Supply & Demand and stocks reports.

Paris November milling wheat futures closed down EUR1.25 at EUR126.00/tonne, and London November feed wheat was unchanged at GBP101.00/tonne.

The USDA report was bearish for wheat and corn, pegging US 2009/10 wheat ending stocks significantly higher than expected at 864 million bushels against trade estimates of 802 million.

Australian wheat output was raised half a million to 23.5 MMT, EU-27 production was seen up over half a million to 139.08 MMT, Canadian output up 2 MMT to 24.5 MMT, Kazakhstan was upped by half a million to 15 MMT and Russian production increased by a million to 57.5 MMT.

None of those increases however were particularly shocking, as this really just brought the USDA's figures into line with other existing trade estimates. Indeed, the most surprising thing is the Russian estimate is still almost certainly too low, and well below that from SovEcon of 60-61 MMT. History would seem to indicate that SovEcon have a much better track record at what is going on in their own backyard than the USDA.

Despite those increases however, global 2009/10 ending stocks were only increased slightly to 186.73 MMT, from 186.61 MMT last month, with global consumption increasing by 2 MMT to 648.15 MMT.

On the domestic market, futures prices have now clawed their way back above the GBP100/tonne mark, with the November close today exactly GBP10/tonne, or almost 11%, above the recent September 9th low.

Back then however the pound was worth USD1.6550 and EUR1.14, so at least some of this gain can be attributed to currency movements. With sterling having subsequently fallen around 4% against the dollar and 6% against the euro since then.

In the same time frame Paris November wheat has risen by a more modest 6%.

Meanwhile, the USDA forecast the US 2009 corn crop at 13.018 billion bushels with an average yield of 164.2 bu/acre. That was higher than the average trade guess of 12.99 billion and 162.7 bu/acre.

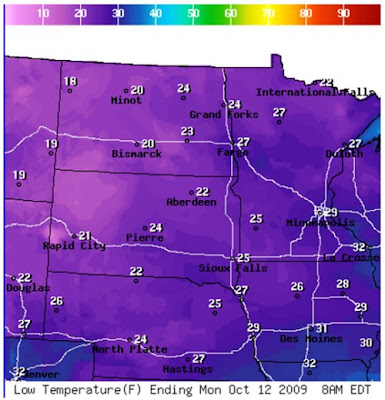

US Weekend Weather: 28F Or Lower

With the USDA report quickly being assigned to the History folder, what the weekend weather has in store might become the dominant issue soon after the opening of CBOT this afternoon.

Half of the corn and soybean crop will experience a hard freeze over the next few days as temperatures drop to 28F or lower from the Dakotas to Missouri, says Allen Motew of QT Weather. Readings will be an unseasonable -35 degrees F below normal over the High Plains and -16 to -24 F below in the Western Corn Belt luckily never reaching these critically cold levels in the Eastern Corn Belt, he says.

Sunday looks like being a pivotal day with sows of up to four inches possible over large parts of South Dakota, edging into northern Kansas. Meanwhile flood concerns are expanding eastward with Flood Watch in effect for SE Illinois and S Indiana, with 6-inch rain totals possible in parts of the Central Corn Belt, he adds.

CBOT Early Calls, USDA Report Reaction

The corn production and yield numbers from the USDA came in above the average guesses. They didn't issue anything outrageous for corn and the figures were within the range of analysts estimates, but maybe not as typically cautious as the USDA normally are.

Harvested acres were reduced for corn, which tempered the increased yield estimate of 164.2 bu/acre.

Harvested area was also cut for soybeans, and yields weren't increased by very much at all, just 0.1 bu/acre to 42.4. Production therefore came in lower than expected at 3.25 billion bushels, although that is still a record.

Chinese output of beans was cut by half a million tonnes to 14.5 MMT and imports raised by a million to 39.5 MMT. Argy production was upped 1.5 MMT to 52.5 MMT.

On the wheat front global production increases were seen for the EU-27, Australia, Russia and Canada. Whilst global ending stocks rose by less than expected, US carryout was much higher than anticipated at 864 million bushels.

I'd say that the numbers are bearish wheat and corn, and slightly friendly for beans.

As often happens with these reports, they are quickly forgotten after the first half hour of trade when the trade gets back to looking at the latest weather forecasts and what the dollar is up to.

Early call: wheat down 5-10 cents, corn down 6-8 cents, beans mixed.

USDA Global Production Highlights

In it's WASDE report there were several significant changes:

Wheat

Australian output was raised half a million to 23.5 MMT, EU-27 production was seen up over half a million to 139.08 MMT, Canadian output up 2 MMT to 24.5 MMT and Russian production up by a million to a still rather low looking 57.5 MMT.

They resisted the temptation to drop Argy production, leaving it unchanged at 8 MMT and Ukraine output was also left unchanged at 20 MMT.

Soybeans

Brazilian production was left steady at 62 MMT and Argy output raise from 51 MMT to 52.5 MMT.

Corn

Chinese production was lowered 5 MMT to 155 MMT.

Global Ending Stocks

Wheat was raised only slightly to 186.73 MMT, from 186.61 MMT last month. Corn was dropped almost 3 MMT to 136.3 MMT and beans were increased more than 4 MMT to 54.79 MMT.

USDA US Crop Production Numbers

The USDA are today forecasting the US 2009 corn crop at 13.018 billion bushels with an average yield of 164.2 bu/acre. That is higher than the average trade guess of 12.99 billion and 162.7 bu/acre.

The soybean numbers are a little below pre-report estimates at 3.25 billion bushels, with a yield of 42.4 bu/acre. The average trade guess was 3.291 and 42.9 bu/acre.

On the 2009/10 ending stocks front, the USDA pegged corn at 1.672 billion bushels (average estimate 1.668 billion), soybeans at 230 million (249 million) and wheat at 864 million (802 million).

Sainsbury's And Asda Under Fire From Beef Industry

The National Beef Association are rightly far from happy that a recent survey by the Agricultural and Horticultural Development Board (AHDB) revealed that only 68% of the fresh beef on Sainsbury's shelves in August was British, whilst in Asda it was even lower at just 45%.

The NBA also pointed out that the percentage of British beef on sale at Sainsbury's and Asda was lower than it had been twelve months previously.

They went on however to praise Budgens, the Co-op, Lidl, M&S, Morrisons and Waitrose for stocking only 100% British beef. These supermarkets would struggle however to raise prices faced with stiff discount competition from two of the so-called 'big four' - thereby keeping prices low for all producers, they said.

And if you want to be sure of buying foreign beef, get yourself down to Netto, in August just 5% of the beef on sale there was British.

I'm A Welsh Farmer With Nothing Better To Do So Put Me On The Telly Isn't It

Proof, if it were needed, that TV producers are running out of ideas comes with the news that S4C are to launch a show called Fferm Ffactor.

Ten Welsh farmers with nothing better to do will compete head-to-head for the dubious honour of being crowned the best farmer in the country. Some would say that won't be difficult, but not me.

The show will sort the men (and ladies) from the boyos by setting them a series of tough challenges such as driving a tractor and building a gate for Christ's sake. What's in the final, putting on your wellies the fastest?

Just to make things interesting the show will be dragged out over ten weeks.

Fferm Ffactor begins on Tuesday, 20 October at 8.25pm on S4C. Riveting stuff, I must get the video set for that then.

A better idea might have been to get them to attempt to succesfully run a creamery near Cardiff. They could have called that Brigend Jones's Dairy.

Cranswick Bringing Home The Bacon

Hull-based pork specialist Cranswick say that first half sales rose by 19%, buoyed by the group’s acquisition of pork farmer Bowes of Norfolk earlier this year.

The group cited the continuing popularity of pork over other types of meat as like-for-like sales rose by 12%, producing a 15% rise in profits for the six months to October.

I reckon my own personal bacon consumption alone accounts for around half of that.

Detailed interim figures will be released on November 16.

GrainCorp To Muscle In On UK Malt Market

Australian grain trading house GrainCorp will become the world's fourth-largest malt producer after agreeing to buy United Malt Holdings in a deal worth around GBP420 million.

The deal is expected to complete by the end of November, provided that it gets the necessary regulatory approval.

UMH is a leading global malt manufacturer producing around one million tonnes annually to distillers and brewers.

The deal is said to include UMH's operations in the US, Canada and here in the UK where they own Bairds Malt, Scotgrain Agriculture and Saxon Agriculture, according to media reports.

German Ethanol Production Leaps

Production of ethanol in Germany leapt by 50% in the first two months of the 2009/10 marketing year (July/August), according to the trade body the Bundesmonopolverwaltung für Branntwein (BfA). Blimey, that's a mouthful isn't it missus?

The closure of the "splash and dash" loophole in the face of the US helped production increase from 105,000 cubic metres in July/August 2008 to 158,000 cubic metres this year, they say.

The main feedstock? Surprisingly not wheat but rye.

They don't mention the war, and why should they? We're all friends now.

What To Expect From The USDA

This afternoon's USDA report is expected to confirm record US soybean production for 2009 with the average trade guess coming in at 3.291 billion bushels, with an average yield of 42.9 bu/acre.

For corn the average estimate is 12.99 billion bu, with an average estimated yield of 162.64 bu/acre.

Wheat 2009/10 ending stocks are expected to increase to 800 million bushels.

There is certainly potential that final production (and wheat ending stocks) might prove to be significantly higher than these average trade guesses. Although, the USDA as we all know are famously cautious about increasing production numbers at times of plenty.

Informa Economics last week said that US soybean production this season would total a record 3.383 billion bushels, with an average yield of 44 bushels per acre. Not wanting to be left out US corn production will also set an all-time record of 13.127 billion bushels with an average yield of 164.7, they said.

In what should prove to be a very interesting report there is also plenty of potential for tinkering with global production numbers too. Wheat output will likely be increased in Russia, Canada and the US. There might also be a few increases elsewhere, although decreases are likely in Brazil and Argentina. Soybean output for next season in Brazil and Argentina will also be of interest.

CBOT Closing Comments

Soybeans

Nov soybeans finished at $9.36, up 24 cents, Oct soymeal finished at $302.70, up $12, and Oct soy oil finished at 34.28 cents, up 55 points. US weather forecasts and the delayed nature of the crop are bullish. Higher crude oil futures and a sharply lower US dollar index added support as well today. However if any significant crop damage fails to emerge then huge production numbers will undoubtedly weigh once we get stuck into the harvest in earnest.

Corn

Dec corn settled at $3.64, up 4 ¼ cents. The crop is late and for once US weather is failing to accommodate, with heavy rain and freezing conditions on the cards for the weekend. Weekly export sales were OK at 521,900 MT, actual shipments for corn of 1,144,200 MT were pretty respectable. Tomorrow's USDA report is expected to show corn production at 12.99 billion bushels, with an average estimated yield of 162.64 bushels per acre, according to the average trade guess.

Wheat

Dec wheat closed at $4.74, up 10 ¾ cents. Weekly export sales of 767,300 MT were up 43 percent from the previous week and 52 percent from the prior 4-week average. The average trade estimate for 2009/10 wheat ending stocks tomorrow is 800 million bushels. The WASDE report could show at least a further 4 or 5 MMT getting added to the global production bottom line for 2009/10.

EU Wheat Continues To Nudge Higher

EU wheat futures continued to nudge higher Thursday with Paris November milling wheat futures closing up EUR1.50 at EUR127.25/tonne, and London November feed wheat ending up GBP0.85 at GBP101.00/tonne.

London futures are now GBP10/tonne higher than their mid-September lows, largely on the back of a weak sterling and lack of producer selling.

It is interesting to note that many of the buyers being flushed out seem to be previously short sellers convinced that the market was going to go down forever.

Although many pundits are saying that tomorrow's USDA report will hold few surprises on the wheat front and that all the activity will come from corn & beans, I'm not quite so convinced.

I think that there is sufficient potential for the UDSA to raise global wheat production by at least 5 MMT, if not 7 MMT. So after the recent rally I think that it would be prudent to bank a few profits and make a couple of sales.

Brazilian Wheat Crop Set To Disappoint, Imports Increasing

The wheat harvest in Brazil looks set to disappoint this year, with production and quality both seen falling due to heavy rains. The same conditions have badly affected the sugar cane harvest, sending prices scurrying to multi-year highs.

The vast majority of Brazilian wheat is grown in the states of Parana and Rio Grande do Sul. In the former harvesting is around half done, whilst in RGdS cutting is only just getting underway.

Persistent heavy rainfall has fallen in both states across the last few months, as can be seen from this map for September:

Early season hopes that wheat output this season might be boosted by 50% to around 6 MMT appear to have been dashed. In Parana, which accounts for more than half of national output, estimates have been cut from 3.5 MMT earlier in the season to 2.7 MMT now. Whilst it is still too early to have an accurate assessment of production in RGdS, anecdotal reports suggest output of around 2.0-2.3 MMT.

With both states accounting for around 90% of national production, it looks like final output this year might only be around 5 MMT.

The rains have also hit quality hard, meaning that more high-grade bread-making wheat will have to be imported in 2009/10, That could push imports up by around 1 MMT in 2009/10 to somewhere in the region of 7 MMT.

With Argentina only set to produce little more than it consumes this year, that could open the door for US wheat to pick-up some much needed export interest, with Brazilian millers famously anti-Russian wheat.

USDA Weekly Export Sales

For the period September 25-October 1, 2009 the USDA report the following weekly export sales:

Wheat

Net sales of 767,300 MT were up 43 percent from the previous week and 52 percent from the prior 4-week average. Increases were reported for Nigeria (159,100 MT), Taiwan (87,500 MT), Japan (86,800 MT), Morocco (52,000 MT), Thailand (50,100 MT), the Philippines (48,000 MT), Yemen (40,000 MT), Chile (37,400 MT), and Canada (37,300 MT).

Corn

Net sales of 521,900 MT were down 57 percent from the previous week. The main homes were Japan (245,300 MT), South Korea (125,900 MT), Mexico (114,600 MT) and Taiwan (69,900 MT).

Soybeans

Net sales of 451,000 MT were down 67 percent from the previous week. The main homes were China (219,600 MT), Japan (88,100 MT) and Thailand (67,000 MT).

When was the last time wheat had the largest weekly export sales of the three? Pre-report estimates were wheat 400,000 to 600,000 MT; corn 650,000 to 1 million MT; beans 675,000 to 925,000 MT.

Actual shipments for wheat were 675,500 MT, for corn 1,144,200 MT and for beans 340,800 MT.

Defra Peg UK Wheat Crop At 14.2 MMT

Defra say that the 2009 UK wheat crop was 14.2 MMT - 300,000 higher than the NFU's 13.9 MMT - but still 18% down on last season. Yields averaged 7.9 MT/ha they say.

They peg barley production at 6.7 MMT, also higher than the NFU's 6.33 MMT and 10% higher than last season, largely due to a significant switch into spring barley. Barley yields averaged 5.8 Mt/ha, they add.

OSR output was 1.9 MMT they say, broadly unchanged from last season's 1.98 MMT. Yields were better than last year at 3.4 MT/ha, they say.

These figures are Defra's first efforts at forecasting the 2009 harvest results, final UK figures won't be issued until January.

Argy Wheat Crop Poses A Few Problems

The Buenos Aires Cereals Exchange say that this season's wheat crop will come in at just 7.1 MMT, even lower than the Rosario Grain Exchange's estimate of 7.4 MMT.

This is the first estimate of the season from the Buenos Aires Exchange, and pegs the crop around 15% lower than last season's 8.3 MMT.

It's no huge surprise with planted area the lowest in history, but it does pose a few interesting problems for the government.

With a domestic requirement of around 6.5-7.0 MMT, that doesn't leave a lot for export does it?

Back in the summer President Cristina Fernández de Kirchner struck a convoluted deal with wheat exporters to get them to buy a million tonnes of old crop wheat. In exchange they got guarantees that the government would issue export licenses for a million tonnes of wheat in the next 2009/10 marketing year.

This deal was an attempt to stimulate the spot market and encourage farmers to up their planting ideas for the current crop. It obviously failed, and now it looks like there isn't going to be a million tonnes to export.

It also throws into question the USDA's current crop estimate of 8 MMT and exports of 1.5 MMT.

Wheat: What The USDA Might Say Friday

The USDA are out Friday lunchtime with their latest Supply & Demand numbers and also revised 2009/10 ending stocks.

I don't see there being anything earth-shattering in the figures, with plenty of private estimates already in the marketplace suggesting quite a few tweaks here and there. However when you start to write them all down, it points to some fairly significant changes.

Global wheat production looks a certainty to be revised higher from last month's 663.72 MMT, the IGC for example already have a figure of 666 MMT.

An increase could come for Europe which the USDA have at 138.485 MMT, Coceral currently say 139.56 MMT, so there is potentially a million tonnes extra there. Last month's USDA report pegged US production at 59.428 MMT, with last week's revised small grains report there is potential to add another million tonnes there too.

Russia, there's a good one, the USDA said only 56.5 MMT last time round, which is clearly well below the mark judging by SovEcon's estimate of 60-61 MMT yesterday. I don't think that they will come in that high for fear of highlighting how off-beam last month's figure was. Maybe 59 MMT, so that adds another 2.5 MMT to the global bottom line.

In Canada the USDA only had production at 22.5 MMT last month, 2 MMT under Stats Canada's recent estimate.

Kazakhstan is a bit of a dark horse with the USDA saying 14.5 MMT last month, there's a bit of potential there for an extra half million or so. In Ukraine 20 MMT is also probably on the low side, with 21 MMT nearer the mark.

Argentina is too high at 8 MMT, the Buenos Aires Cereals Exchange now say only 7.1 MMT and the Rosario Grain Exchange 7.4 MMT. With the USDA's 'safety first' approach, half a million off to 7.5 MMT is on the cards there.

If we tot that lot up we have an extra 4.5 MMT from Europe, the US and Russia, 2 MMT from Canada, plus say a further million from Kazakh/Ukraine less a half from the Argies, that's seven million tonnes that they could easily 'find' from last month.

That might frighten them a bit, so I'll go for an extra 5 MMT getting added to the bottom line.

With all this extra production, some tweaking of global consumption and ending stocks is also on the cards. Usage in India could certainly increase due to sharply lower summer crop production. They might also pencil in a bit of extra consumption in Europe with low prices stimulating demand and increased usage next year from the biofuel sector.

Even so, global ending stocks will probably rise by 3 MMT or so from last month's 186.61 MMT.

For US 2009/10 ending stocks, although weekly exports have held up quite well the past few weeks, the expected increase in US production will almost certainly add to those too. Potentially finding another 5 MMT+ globally will hardly improve the outlook for US exports either.

The USDA's September estimate of 743 million bushels seems likely to be pushing the 800 million mark by Friday afternoon.

EU Wheat Closes Mixed

EU wheat futures closed higher Wednesday with November Paris milling wheat ending up EUR0.50 at EUR125.75/tonne, and London November feed wheat ending down GBP0.50 at GBP100.15/tonne.

London wheat was again sharply higher earlier in the session, but failed to hold onto those gains as farmer selling kicked in.

Increased production from Russia was forecast by SovEcon, and a sharply reduced intervention buying programme for 2009/10 by the Russians might also have a negative impact on the competitiveness of EU wheat on the export front.

The German Ag Ministry say that wheat output there will come in at just under 25.2 MMT (including a small amount of durum wheat) this season. That is more than a million tonnes under some other private estimates from the likes of the IGC.

Wheat production in Argentina is seen at just 7.1 MMT according to the Buenos Aires Cereals Exchange. That's 15% down on last season, and less than half what they've been used to producing.

CBOT Closing Comments

Soybeans

Nov soybeans closed at $9.12, up 2 cents, and Oct soymeal closed at $290.70, up $5.20. Weather remains a concern with wet cold and freezing conditions forecast for the end of the week. CONAB say that Brazilian soybean production will rise to 62.3-63.3 MMT in 2010, up from 57 MMT last season. Estimates for tomorrow's USDA weekly export sales report range from 675,000 to 925,000 MT.

Corn

Dec corn settled at $3.59 ¾, up 1 ½ cents. Rain, snow and frost are all in the forecast for later this week in the Midwest. That will maybe knock a few bushels off yields, but will certainly cause quality issues with this late developing crop. A higher US dollar and lower crude oil futures pressured futures, limiting some upside movement. Trade estimates ahead of Thursday's USDA weekly export sales report for corn range from 650,000 to 1 million MT.

Wheat

CBOT wheat finished at $4.63 ¼, up 3 cents. Japan is looking for 147,000 MT of wheat in it's usual weekly tender tomorrow, 86,000 MT of that will be US origin. SovEcon say that the Russian wheat crop will now amount to 60-61 MMT, back in the summer they were forecasting only 55 MMT. Estimates ahead of Thursday's USDA weekly export sales report for wheat range from 400,000 to 600,000 MT.

US Weather: Jingle Bells

I guess if you've had beneficial weather for this long you have to be expecting a kick in the teeth sometime.

Wet weather begins in earnest Thursday from Wisconsin to Texas. Heaviest rains will fall in Missouri and Illinois with 3-4 inch totals, says Allan Motew of QT Weather.

Snow and cold also arrives in two waves, the first from South Dakota to Kansas Thursday then a larger area in the Dakotas, Nebraska, Kansas, Minnesota and NW Iowa, Saturday. Snow and a cold rain are also possible in Illinois Sunday, and Michigan, Indiana and Ohio Monday, says Allen.

One to two inch snows start tonight in South Dakota, with falls of up to five inches in the Black Hills, before snow pushes on to reach Nebraska, NW Kansas and even E Colorado too, with anything from a trace to three inches possible, he adds.

Additionally, elsewhere there will be halted harvest progress for many farmers as rains leave flooded fields from Oklahoma to Ohio, Thursday and Friday. After that a second round of snow falls Friday and Saturday this time reaching eastward into Minnesota, E Nebraska, W Iowa and NE Kansas. NE North Dakota can expect greater than 6 inches he says.

Following on from that lot, the next system arrives late next week (Friday/Saturday) across all ready soggy Missouri, Illinois and Indiana, he concludes.

SovEcon Increases Russian Crop Estimates

This season's Russian grain crop will now total 96-97.5 MMT in clean weight, say SovEcon, significantly higher than the official Russian Ag Ministry of Lies forecast of 90 MMT. That's around 10-11% down on last season's 108.1 MMT.

The wheat crop will now amount to 60-61 MMT, they say, a reduction of around 5% on 2008's 63.8 MMT.

eCBOT Close, Early Call, US Selling Ethanol To Brazil?

The overnight session closed mostly a little higher with wheat and corn up around 2 cents or so and beans down 3/4 to up 1 1/4 cents.

Rain and freezing conditions are on the way for the US Midwest with snow in the northern and central Plains.

Whilst this might not knock too much off final yields it is enough to keep the market a little nervous. Quality might be more of an issue though. The cool and wet summer has caused some problems with mold in early harvested corn, according to some reports.

Stories are also circulating that the US has sold corn ethanol to Brazil, normally the world's largest ethanol exporter. The story goes that with world sugar prices so high Brazil is using it's sugar cane to make sugar not ethanol, and might soon start to import US product as all gasoline sold in the country contains 25% ethanol.

There are obvious bullish demand implications for US corn if that proves to be the case. Rabobank recently pegged US corn for ethanol use in 2009/10 at 4.3 billion bushels, or around a third of the entire US crop.

Brazil will produce around 51-52 MMT of corn in 2009/10, say CONAB, a similar amount to last season. Soybean production will rise to 62.3-63.3 MMT, they say, up from 57 MMT last season. The soybean estimate is in line with Abiove's prediction of 63.4 MMT late last week.

Japan is looking for 147,000 MT of wheat in it's usual weekly tender. 86,000 MT of that will be US origin.

Speculative funds and traders are still short big-time on CBOT wheat, leaving the market vulnerable to a sharp upwards correction as was witnessed last night.

Early calls for this afternoon's CBOT session: corn called 2 to 3 higher; beans called steady to 2 higher; wheat called 1 to 3 higher.

I See That The Egyptians Are At It Again

We've moved on a level or two from faking your own import documents and quality certificates here.

Egyptian politicians have called for the innovative Artificial Virginity Hymen Kit to be banned.

You think I'm definitely making this one up don't you?

Would I lie to you baby?

How Big Is Germany's Wheat Crop?

The IGC recently said 26.4 MMT, a small increase on last season despite reduced plantings, with yields averaging around 8 MT/ha.

The agriculture ministry have just upped their estimate by 100,000 MT, but still only to just shy of 25.2 MMT (including a small amount of durum wheat).

That's a fairly substantial difference of opinion is it not? Not as substantial as getting confused over which adjacent countries belong to you granted, but significant nevertheless.

Barley output is held steady at 12.3 MMT (12.0 MMT in 2008), whilst rapeseed production is also increased by 100,000 MT to 6.3 MMT, 21% higher than in 2008.

Argy 2010 Soybean Crop Seen Up 62%

Argentina will produce 52 MMT of soybeans in 2010, according to the US agricultural attaché. That's an increase of 62.5% on last season drought-riddled crop of just 32 MMT.

Plantings will come in at a record 18.5 million hectares, up 7.5% from last year's 17.2 million ha, he says.

Yields will come in at 2.81 MT/ha, up from just 2.00 MT/ha in 2009, he estimates.

The increased production will enable domestic crush (in the marketing year Apr10/Mar11) to increase to 37.0 MMT from 32.5 MMT. Bean exports will almost triple to 12.0 MMT from 4.2 MMT, he says.

He also forecasts sunseed output at 3.5 MMT (2.9), with plantings up to 2.0 million hectares (1.8) and a yield of 1.75 MT/ha (1.60).

Note: His record soybean area figure of 18.5 million hectares is actually towards the low end of some trade estimates, 19-20 million have been mentioned elsewhere. They've just dropped their wheat planted area alone by almost 1.5 million hectares remember.

Taxi Driver And 13 Year Old Girl Win Ploughing Competitions

Bill Tonkin, a Cheddon Fitzpaine taxi driver, took the overall championship ploughing cup in this weekend’s Crewkerne Young Farmers Club annual ploughing match. He obviously took his time as the meter was running. Why anybody should be surprised about a taxi driver driving up and down a field fifteen times when he could have simply gone straight across it is beyond me.

Meanwhile, a 13-year-old school girl beat 40 experienced rivals to claim first place in a ploughing competition at Redbourn Berry Farm, Herts. The girl, Elly Deacon, had only driven a tractor for the first time four days before the event and had just four hours worth of practice. It's a good job she didn't have to reverse it into a parking space as well that's all I can say.

UK Winter Planting Progress

The very dry September allowed good progress to be made with drilling crops for 2010, say ADAS.

All winter oilseed rape crops have now been drilled with the earliest sown crops now well established. Later sown OSR, which went into much drier ground, has struggled to emerge they say.

Winter wheat drilling began in early September followed by winter barley, second wheats and winter oats. An estimated 50—60% of winter cereals were drilled by the end of September, they add.

As with OSR, cereals drilled early into moist seedbeds have emerged and are now at around 1-2 leaf stage. For crops drilled later into dry seed beds emergence is more patchy, they conclude.

Lower fertiliser prices, poor malting barley prices and the prospect of no barley intervention next year could see more wheat and oilseed rape getting planted this winter.

ADAS see UK wheat plantings rising to 2 million hectares from 1.8 million hectares in 2008. OSR area should also increase from 571,700 hectares to 600,000 hectares or more, they say.

Barley plantings will lose out, particularly spring barley which saw an increase of a third this season to 424,400 hectares.

A change EU subsidy rules, aimed at encouraging cultivation of a wider range of crops, which comes into effect in 2010 may also promote a bit of diversification into other protein crops such as peas.

Indian Politics, Lying And Time-Wasting

It's a good job we don't play them at football, that's all I can say.

If you thought that our own politicians were a namby pamby bunch of in it for myself ne'er-do-well Johnny come-lately's then take a shuftie at India. What a nest of self-centred smarmy exponents of the art of untruths they are.

Having told reporters only yesterday that the government would release 1.5 MMT of wheat onto the domestic market to stave off spiraling food prices, India's junior food minister K.V. Thomas today has upped the ante now saying that 3 MMT will soon be released. (Note the avoidance of a specific date when this fantastic event will actually occur).

Of course, we've been hearing this for months now, and for months nothing has happened. They've got 30 million tonnes of wheat in store for a rainy day, we all know that. Well Tommo my old chumbawumba it's raining cats & dogs out there so show me your money.

Hang on, calm down, calm down...Indian Finance Minister Pranab Mukherjee, is playing down increased food prices pushing up inflation after the worst monsoon rains since 1972 hit summer crops.

"Even if there is shortfall of grains to the extent of 10 million tons in this year, the surplus we have (makes it)...manageable," Mukherjee is quoted as saying. "I'm not overly concerned with that."

Well I'm glad that YOU aren't overly concerned, the hungry masses might see the situation differently. So get your finger out Mukherjee my old mucker, and release the wheat rather than talking about it.

Hang on a minute, there's a slight problem, didn't see this one coming did we boys & girls...

Mukherjee says that the government need to wait and see to what extent winter crops can compensate for summer crop losses, and that they can't do that until "end of November, the middle of December."

Now, does anyone smell a rodent?

Ukraine Harvest/Exports

The harvest in Ukraine is drawing to a close with 90% of the planted area cut as at Oct 6, producing 40.35 MMT of grain.

Unlike their Russian counterparts, the Ukrainian ag Ministry's forecast of a crop of 42-43 MMT looks pretty accurate, a reduction of about 20% on last year.

Undaunted by lower output cash-starved Ukraine are matching last year's record export pace, having shipped 6.6 MMT already in the first three months of the marketing year to Sept 30. That's well over a third of their 2009/10 MY target of 18 MMT gone already.

Of that total 3.7 MMT was wheat, which is 15% up on the first three months of MY 2008/09.

On a positive note for the rest of us, at these rates the Ukrainian cupboards should be bear by the spring.

I've got a funny feeling about Ukraine. I feel somehow that they might have turned up at a party fashionably late, thinking they were cool clutching a bottle of Lambrini, only to find just a couple of die hard stragglers left.

Europe's over there throwing up down the back of the sofa. Russia's gone off to his private club in town with all the nice birds. And there's only the ugly twins of Bulgaria & Romania wearing skirts that are far too tight, with faces like a bulldog licking p*ss off a nettle, left.

Still, there's always next year's Eurovision entry to work on. "Happy ding dong p*ss p*ss boom boom" I think it's called, it's ever so catchy 12/1 with Ladbrokes, get in.

Buy, Buy, Buy

Gold ‘Off The Charts’ is a headline that catches my eye this morning. Gold reached a record $1,043.78 an ounce yesterday on ideas that owning the commodity is better than putting money in the bank with interest rates at fourth fifths of bugger all.

Let's all pile in on this sure thing, bullion has “significant upside potential” to reach as high as $1,500 an ounce, Barclays Capital gleefully tell us, not that they have a vested interest you understand.

Bloody hell if only I'd held onto those rings that Mrs Nogger #1 and #2 threw back at me I'd be quids in. Even the infamous cubic zircona one must have had some gold in it surely? I used to wear #2's ring as well as it happens.

It seems that these investment houses are DESPERATE for something to hang their hats on at the moment. They seem to have done quite well out of cocoa and sugar recently too, how long before their attention turns back to that well-known biofuel feedstock wheat?

Here's Something You Probably Didn't Know

The Reserve Bank of Australia put interest rates up by 25 basis points to 3.25 percent yesterday.

What the chuffing Nora has that got to do with anything Nogger, I hear you ask.

Well, it's quite shocking when you think about it. Such a relatively low interest rate, wouldn't we all have loved to have had a 3.25% mortgage for the last twenty years, just happens to be six and a half times better than what your money gets you here in the UK.

Suddenly anywhere that's safe and offers the dizzy heights of 3.25% looks mightily attractive for investors.

So much so in fact that the Ozzie dollar hit its highest level against sterling since early 1985 yesterday.

Still, who's got the ashes eh?

Chicago Closing Comments

Soybeans

Nov soybean closed at $9.10, up 25 cents, and Oct soymeal closed at $285.50, up $10.00. Rain, cold, snow and freezing temperatures are forecast for large parts of the northern Midwest over the next week or so. Given the late nature of this season's crop the market seemed to need to add a bit of 'protection money' into current prices. A sharply lower US dollar index and higher crude oil futures provided additional outside market support.

Corn

Dec corn finished at $3.58 ¼, up 16 ¾ cents. A poor weekend weather forecast, given the slow state of crop maturity announced by the USDA last night is making the market a bit nervous. A sharply lower US dollar index and higher crude oil futures provided additional outside market support.

Wheat

Wheat settled at $4.60 ¼, up 17 ½ cents. Spillover strength from beans and corn helped wheat today, as did a steeply dropping US dollar index. Whilst spec shorts have reduced their exposure recently, they are still heavily short on wheat. That leaves the market vulnerable to a corrective bounce for little or no apparent reason.

EU Wheat Closes Higher

EU wheat futures confounded the "world is awash with wheat" brigade by closing sharply higher Tuesday.

November Paris milling wheat closed up EUR1.75 at EUR125.25/tonne, whilst London November feed wheat traded up GBP2.05 at GBP100.65/tonne.

Certainly a very poor performance by the pound helped support London wheat today.

EU farmers don't much care for the look of current bids and are busy planting rather than selling at the moment.

Still, consumers have seen wheat prices come down a very long way since the beginning of June and are in no mood to capitulate just yet, despite recent price rises.

It still seems like winter wheat plantings in western Europe will be higher for the 2010 harvest, but things could be markedly different elsewhere.

Most parts of the UK appear to have had a much-needed very good soaking of rain over the last 24 hours.

More Russian Lies

This season's Russian grain harvest now amounts to 93 MMT as of October 6, off 39 million hectares, or 85% of the planted area.

That's 3 MMT more than the official government estimate for the entire crop, with 15% still left to be harvested.

Only last week did Russia's farm minister Yelena Skrynnik finally grudgingly raise her official estimate from 85 MMT to 90 MMT, and already she's been caught out trotting out another load of complete pants.

Still, here's a much more interesting fact.....

The word Skrynnik in Scrabble (obviously it has eight letters so you are using a letter already on the board) is worth what? That's right Yelena Skrynnik is worth a 69.

The Big Freeze

A widespread freeze is on the cards for the US Midwest this weekend with temperatures forecast to fall as low as 19 degrees in the Dakotas on Sunday night, according to QT Weather.

Freezing temperatures will push as far south as Nebraska, and will also reach into northern Missouri and Central Illinois, they say.

Temperatures will be 12-24 degrees below normal over the Western Corn Belt and Northern through Central Plains Sunday. Before that snow will work its way across the Dakotas Friday and Nebraska into W Iowa Saturday evening. Snow is also seen for N Minnesota and NW Wisconsin, they add.

Whether this scenario has come too late to knock anything off yields remains to be seen. Certainly last night's progress figures from the USDA would appear to suggest that it might.

India Finds The Key To The Magic Cupboard

Hurrah, India's junior food minister K.V. Thomas has told reporters that he's found the key to the magic wheat cupboard. All will soon be well and the country's population of over a billion will be able to get some bread very shortly.

If I read one more time that "the government's wheat stockpiles as of Sept 1st were 30 million tonnes" then I will surely burst a blood vessel.

The government will release a whopping 1.5 MMT of wheat onto the domestic market "in phases over the next two to three months" says Thomas.

Well that's going to sort the job out isn't it Tommo? Does anyone here remember that episode of the Young Ones where they're having a party back at the house? Assorted student types turn up for a p*ss up and Rik casually tosses a group of them four of those very small cans of lager that you get in hotel mini-bars saying "there you go get stuck into that lot."

That's about as much use as 1.5 MMT is spread over 2-3 months in a country that consumes almost 6.5 MMT/month of the stuff.

Pound Takes Another Hammering

I've written here before recently that the pound appears to be competing head-to-head with the dollar as to which of the majors is the weakest currency.

At the moment sterling appears to be winning that particular race in the style of a thoroughbred.

UK industrial production data out today came in devastatingly weak, and much lower than forecast, forcing some heavy selling of the pound across the board.

UK industrial outputs unexpectedly plunged 2.5% in August after rising 0.5% in the previous month, with the annual rate of production tumbling 11.3% from the previous year, while manufacturing slipped 1.9% from July to mark the lowest level of outputs since 1992.

The data appears to underline the fact that the Bank of England’s unprecedented steps to shore up the ailing economy will need to continue for some time. Indeed, the chances of having to extend QE measures as soon as November suddenly look a lot more likely.

Meanwhile, investors continue to speculate that the European Central Bank will tighten it’s fiscal policy next year. ECB council member Erkki Liikanen said that central bank will withdraw its emergency programs “when the economic situation allows.”

Parity here we come.

EU Wheat Ends Marginally Higher

EU wheat futures started the week closing marginally higher with November Paris milling wheat closing up EUR0.25 at EUR123.25/tonne, and London November feed wheat ending up GBP0.10 at GBP98.60/tonne.

Rolling forward of November longs into January was a feature. Traders still report that farmer retention remains strong, despite recent price rises.

Growers are busying themselves with winter drilling, and increased wheat and rapeseed plantings look to be on the cards at the expense of barley.

Most pundits are projecting the UK wheat area rising from 1.8 million hectares to around 2 million for the 2010 harvest. Similarly the UK OSR area is seen growing from 571,700 ha to "at least 600,000 ha," according to ADAS.

A very dry September is a concern for UK and many EU producers, as newly planted OSR (and in some cases wheat) has not got off to a very good start. In the UK most of the country is expected to get a fairly good soaking Tuesday. The first for more than a month in many parts, after large parts of the UK got only a fifth of normal rainfall during September.

CBOT Closing Comments

Soybeans

Nov soybeans closed unchanged at $8.85/bushel, with Oct soymeal closing at $275.50, up $3.50, and Oct soyoil closing at 33.53 cents, down 20 points. Support came from a weaker dollar and US weather forecasts calling for periods of rain this week combined with below normal temperatures. After the close of pit trading, the USDA reported soybean harvest at 15% completed which fell well below trade estimates. Soybean maturity came in at 79%, which is 9 percentage points behind the 5-year average.

Corn

Dec corn settled at $3.41 ½, up 8 cents, hitting an eight-week high earlier in the session on ideas that cold and wet weather will further delay an already late US corn crop. Better than expected weekly export inspections at 38.405 million bushels provided support as well. After the close of trading, the USDA reported corn harvest at 10% completed which fell on low end of trade estimates. Corn maturity came in at 57%, which is 27 percentage points behind the 5-year average.

Wheat

December wheat finished at $4.42 ¾, up 1 ½ cents. Spillover from corn lent supportive tone to wheat futures, as did a weaker US dollar. After the close of pit trading, the USDA reported spring wheat harvest at 97% completed and winter wheat plantings at 53% completed. Spec money liquidated some of its heavy shorts in wheat last week, according to CFTC data. Although most of the major media reports still trend on the side of bearishness towards wheat, the sheer weight of spec shorts leaves the market vulnerable to a corrective upswing for little or no reason.

eCBOT Close, Early Call

The overnight market closed mixed with beans around 4 cents lower, corn a cent or two easier and wheat around a cent higher.

A weak dollar is supportive to grains, but record soybean and corn production is imminent. I think that prices may work lower throughout the session, as traders start to think about the USDA report on Friday at least partially concurring with Informa and FCStone from last week.

Brazil will produce a record 63.4 MMT of soybeans in 2009/10, according to Abiove. That's 1.4 MMT more than the USDA's September estimate and an 11% increase on last season.

And Lord knows how many beans Argentine farmers will plant, suffice to say acreage there will comfortably exceed anything that they have seeded before.

Iraq, Morocco, Jordan and Bangladesh are all tendering for wheat.

Spec funds and non-commercial traders are still heavily short in CBOT wheat but have reduced the size of their liabilities this last week.

Crude oil is lower at around $68.50/barrel.

Early calls for this afternoon's CBOT session: corn called steady to 2 lower; beans called 2 to 4 lower; wheat called flat to 2 higher.

Market Bites

Morocco is tendering for up to 600,000 MT of wheat according to some reports. There are apparently some financial inducements available on US wheat that aren't applicable to other origins. This may help at least some of the tender to be won by US sellers.

Iraq are also in the market for 100,000 MT of wheat and Bangladesh is to tender for 60,000 MT of wheat for Nov/Dec delivery.

Kazakhstan say that this years grain harvest will total almost 21 MMT in bunker weight, and that the country will export 9-10 MMT of grains in the 2009/10 marketing year.

Late rains in India might help winter wheat plantings this month, as every cloud has a silver lining. However summer rice production in key state of Andhra Pradesh might be down as much as 30%. Summer soybean output in the states of Madhya Pradesh and Maharashtra is also being hit by late season floods just as the crop is ready to be harvested.

It's a new month so that means another BoE meeting of the MPC Thursday. No changes are expected to interest rates or the level of QE just yet.

The dollar is down after poor jobs data Friday, and as G7 finance ministers stayed silent on the recent weakness in the greenback at their summit in Istanbul over the weekend. The pound has just popped back above $1.60.

The overnight eCBOT market is narrowly mixed, with a weak dollar supportive but recent crop estimates from Informa and FCStone likely pointing to an upward revision in US production numbers from the USDA on Friday.

Egypt Seize French Wheat

In the latest twist to the ongoing saga of Egyptian wheat quality-control standards suddenly becoming the most exacting in the world, a 63,000 MT cargo of French wheat has been seized by the authorities.

The wheat, which arrived in the port of Sagafa on Sept 19, is said to contain 'poisonous' seeds at more than double the permitted limit of 20 seeds/kg.

It may be possible to removed the seeds by sieving to make it conform to GASC's exacting standards after which it may be released to enter the food chain or be re-exported, the local quarantine authorities say. The picky buggers.