EU Wheat Closes Lower

EU wheat futures closed lower Friday with Paris May milling wheat ending down EUR1.25 at EUR138.00/tonne. London November feed wheat closed down GBP1.50 at GBP123.50/tonne.

Large old crop stocks continue to weigh on the market although farmer selling is light.

Algeria might buy French wheat in its 300,000mt tender some traders said, as the exact detail of the tender is for EU, US or Argentine wheat. Russian wheat may not therefore be deemed acceptable.

Other than that there is precious little export interest around that is likely to come our way, or so it seems.

Currency fluctuations are heavily influencing the market at the moment, with a dearth of fundamental news. Whilst the pound has been fairly steady against the euro this week, it has been all over the shop against the dollar, trading in a five cent range from $1.41 to $1.46.

CBOT Closing Comments - Friday

Soybeans

Beans closed mixed with front-month March 5 1/4 cents higher, yet new-crop Nov was 10 1/2 cents lower. The nears got a boost from widespread reports that the Argy government is studying a plan to nationalize the country's grain trade. Who wouldn't like to be a fly on the wall at Tuesday's scheduled meeting between farm leaders and the government? That is if it goes ahead at all now in light of these latest reports. A widespread strike now seems highly likely I'd have thought, and quite possibly on a scale that makes last years dispute seem like a walk in the park. Agroconsult has estimated the Brazil soybean crop at 55.5 mmt, 1.5mmt lower than the USDA's Feb 10 estimate.

Corn

Corn closed sharply lower with March down 11 1/4 cents. The USDA stating that it expected US farmers to plant the same acreage as last year surprised the trade. A significant switch into soybeans had been what pretty much everyone had been expecting. The US Ag attaché estimated the Brazilian crop at 49.5 mmt, the same as the USDA's Feb 10 assessment. Around 15% of US ethanol capacity is idle according to reports, that is despite production in December reaching a record 20.342 million barrels. Obama is of course fiercely pro fuel from renewable sources and it wouldn't be out of the question to see some changes in legislation getting pushed through to increase ethanol usage.

Wheat

March wheat closed 3 1/2 cents lower. The USDA came out with 5 million fewer acres for wheat plantings, and final production for 2009 down more than 10mmt. Whilst Thursday's export sales were pretty respectable for wheat, Russia continues to mop up the big orders. Drought remains a threat to US crops emerging from winter dormancy:

Breaking News: Argy Dispute May Be About To Take New Twist

Argy daily newspapers La Nacion and Clarin are both carrying front page news items today suggesting that the government has plans to transfer control of all purchases and exports of agricultural commodities to the agricultural trade office.

A government source is quoted as saying that he/she "didn't have any knowledge" of such a plan. Clearly that doesn't mean that it doesn't exist, and even if the government outright denied it, that also wouldn't mean that it didn't exist.

With renewed talks set for Tuesday these reports are bound to stir up tensions amongst the farmers and their leaders.

I'm getting the word STRIKE.

eCBOT Close, Early Call

eCBOT grains closed lower, with beans down 13-15 cents, wheat off 3-4 cents and corn down 3-5 cents.

The USDA are pegging US wheat acres down 5 million to 58m acres this year. With yields also seen lower due to drought conditions at 43bu/acre (from 44.9bu/acre) final production is now pegged 15% lower than in 2008 at 2.12 billion bushels (or 57.7mmt, from 68mmt in 2008).

US farmers are expected to plant 77 million acres of soybeans in 2009 (from 75.7m in 2008), yielding 42.6bu/acre (39.6) to give a final production of 3.24 billion bushels (2.969). That would be the largest production number on record.

Corn is expected to be planted on a similar acreage to last season, they say, at 86 million acres, yielding 156.9bu/acre (153.9) and giving final output of 12.365 billion bushels. That would be the second largest production number in history.

The USDA numbers are bearish soybeans and corn and bullish on wheat. Wheat may struggle to rally however, and seems likely to be dragged lower by the other two pits.

Crude oil is around a dollar and a half lower, and the US dollar is also firmer which may weigh on the complex.

The weather outlook in the US remains a threat to wheat, although drought conditions in China have improved.

For soybeans at least the weather in Argentina has improved crop chances there, with above normal rainfall for most areas during February, except Buenos Aires province. Another round of heavy rainfall next week may also take in some parts of Buenos Aires, according to some forecasts.

Early calls for this afternoon's CBOT session: Corn futures are expected to open 5 to 6 lower; soybeans 13 to 15 lower; wheat steady to 3 lower.

USDA Acreage Numbers Don't Stack Up

There seems to be a lot of head scratching going on at the USDA's Annual Agricultural Outlook Forum.

They are pegging wheat acres 5m lower in 2009 at 58m acres. I don't think that anyone is particularly shocked by that, wheat plantings down around 8% on last year. It could have been more.

What is a surprise is only upping soybeans acres by 1.3m to 77m AND leaving corn acres unchanged at 86m.

So we've lost 5m acres of wheat and only gained 1.3m on beans, what's happened to the rest? I really don't see them being switched into cotton. Or were last years acres overestimated by 3.7m?

And if last years acres were overstated, that means that all the current stocks data is miles out too.

Why on earth would US farmers plant the same acres of corn as they did a year ago when crude was over $100/barrel? Are they stupid? The USDA seem to think so.

Or is it that the USDA don't know their arse from a hole in the ground?

I know where my money is going.

If there's anyone from the USD ARSE A reading this might help: Amazing Holes

Russian Grain Bottleneck

They might have lots of grain to sell, and they might be "never knowingly undersold" but even once the sale is made it still has to be delivered.

Therein lies the problem, with Russian railway authority RZhD putting a temporary ban on the movement of grain into the Black Sea port of Novorossiisk as thousands of unloaded railcars back up on the approaches to the docks.

Russian exports via Ukraine have virtually ceased in the aftermath of the recent gas dispute, with just 100 railcars reportedly passing through that route during January, a fraction of what would normally go through.

Russia has also reduced the rail tariff for grain exported via Russian ports, but not those via Ukraine.

The grain terminal at Novorossiisk is said to be capable of handling around half a million tonnes/month of exports.

Russia expects to export 18-20 million tonnes of grain in the current marketing year.

Lloyds Buy Pig In A Poke For GBP10.8 Billion

Lloyds Banking Group shares fell 14% this morning, leading the FSTE lower, after they revealed that HBOS made a pre-tax loss of £10.8bn in 2008.

HBOS took a £9.9 billion hit on bad loans, it says.

Lloyds themselves did manage to turn in a profit, albeit only £807 million, 80% down on a year ago. They haven't quite joined the club yet, but are still in talks with the government regarding their participation in the asset protection scheme.

Still, they did manage to claw back £25 of their losses from yours truly when my personal account went overdrawn by £1.71, so all-in-all it could have been worse eh lads? City analysts point out however that my £25 won't show up in the accounts until next year.

Frozen Brazilian Chickens Arses Shaped Like Doctor Who For Tea

Asda and Tesco are at it again I see, arguing over exactly whose Dad is biggest.

No sooner had Tesco announced it was cutting prices on more than 3,500 items, than Asda responded with cuts on 5,000 of it's own.

Yes, but we are cutting prices on loads frozen food items to just £1, said Tesco. Yum, yum let's fill the bloody trolley. We can dine like kings on frozen chickens arses for a whole year.

Yes, but I don't want to be your friend no more because you showed William Morrison your knickers in the boys toilets and your Mum's got a moustache and stinks of wee.

CBOT Closing Comments

Corn

March corn futures finished lower this session. December contracts also finished lower. Higher crude oil futures and a lower US dollar index for the day gave support to corn. This morning the USDA released its weekly export sales report for the week ending February 19. Net sales of US corn exports were near 449,000 metric tons, a 66% decrease from the previous week. This was well below analysts’ estimates. During this morning’s Agricultural Outlook Forum, the USDA forecasted 86 million acres for the 2009 US corn plantings, an increase from 2008 of 85.99 million. Analysts’ expected a reduction greater than what was announced. These two USDA releases provided some pressure. Cash corn bids were firm for the day with light farmer selling around the Midwest. March corn finished at $3.62, down 1 ¾ cents; December corn finished at $4.02 ¼, down 1 ½ cents.

Soybeans

March soy complex closed lower this session, while November soybean contracts closed unchanged. Friday is the first notice day for delivery for March corn future contracts. Higher crude oil futures and a lower US dollar index for the day gave support to the soy complex. This morning the USDA released its weekly export sales report for the week ending February 19. Net sales of US soybean exports were near 339,000 metric tons, a 69% decrease from the previous week. This was below analysts’ estimates. During this morning’s Agricultural Outlook Forum, the USDA forecasts the 2009 US soybean plantings at 77 million acres, an increase from 2008 of 75.7 million. Analysts’ expected an increase of 2 to 3 million. These two USDA releases weighed on soy. This morning the US Census released its January 2009 crush report. January soybean crush was 145 million bushels, which was slightly below analysts’ estimates. Spillover from March soybean contracts gave pressure to soy oil and soy meal. Cash soybean bids were firm for the day with light farmer selling around the Midwest. March soybeans closed at $8.69 ¼, down 8 ¾ cents; November soybeans closed at $8.38, unchanged.

Wheat

March wheat futures in all three grain exchanges settled lower for the day. A lower US dollar index during wheat trading gave support to wheat. This morning the USDA released its weekly export sales for the week ending February 19. Net US wheat sales were 465,000 metric tons, a 7.4% increase from the previous week. This was well above analysts’ estimates and gave further support to wheat futures. Also this morning the USDA at its Agricultural Outlook Forum forecasted 2009 US wheat plantings at 58 million acres, a reduction from 2008 of 63 million. Analysts’ expected a reduction of acreage and this announcement gave mild support to wheat futures. Updated weather forecast for HRW wheat crops areas of the southern Plains called for limited chances for rain in the next week and a half. Spillover pressure from soy and corn weighed on wheat. March CBOT wheat settled at $5.14, down 10 ¾ cents.

More Rain On The Way For Argentina

“Rainmakers” in Argentina have been successful in turning around seasonal precipitation totals as thirty day amounts have exceeded 200% of normal in prime “bean” country and more heavy rain is on the way, according to Allen Motew of QT Weather.

From Santa Fe to Uruguay, 150-200% of normal rainfall occurred over the past 30 days. Widespread “normal” amounts were more than appreciated after six months of drought and heat decimated water supplies, forage land, cattle, and the wheat and corn crops. However drought conditions still plague La Pampa to southern Buenos Aires, QT Weather say.

Next week will see another round of heavy rainfall, which may also hit the drier regions of southern Buenos Aires too, according to their latest forecast.

eCBOT Close, Early Call, Export Sales

The overnights closed mixed, mostly lower, with beans down around 6 cents, wheat off 3-4 cents and corn up around a cent.

Beans are seen as the most vulnerable leg of the three with ideas that US farmers will plant substantially more of the crop in 2009.

Talk of China cancelling three cargoes of soybeans and switching it's tactics to buying soyoil instead is also seen as bearish beans. Crop concerns for soy in Argentina have also eased.

Corn is getting a little boost from expectations of lower plantings in the US this spring. In addition ideas are that rains in Argentina came a wee bit too late to help corn much.

Also favouring corn at the moment has been Obama speaking of greater use of fuels from renewable sources, plus the fact that weekly exports have been very strong recently, with sales in excess of 1 MMT for the last five weeks running.

Unfortunately that little winning run was brought to an end this afternoon.

Crude oil is up to the dizzy heights of $43.60/barrel following a greater-than-expected fall in U.S. gasoline inventories. Meanwhile, crude oil inventories did not rise as much as expected. OPEC is also expected to drop production by another 1 million barrels per day at its March meeting in an attempt to shore up prices.

Wheat is garnering support from dryness in the US and the outlook for lower world production in 2009. Russia keeps picking up the "big ticket" export sales booking Egypt for 240,000 MT and Syria for 200,000 MT this past week. They are also hot favourites to land a 300,000 MT tender in the market at the moment from Algeria.

In it's usual weekly export sales the USDA reported wheat sales for 08/09 of 465,400MT and 112,500 MT for 09/10. For corn sales were a disappointment at 448,900 MT for this marketing year and 8,100 MT for 09/10. For soybeans net sales were 339,400 MT for 08/09 and 8,300 MT for 09/10.

Wheat sales of 577,900 MT in total were a little above expectations with the main homes being Taiwan (91,800 MT), Nigeria (86,000 MT), unknown destinations (61,500 MT), Yemen (52,800 MT), China (50,000 MT), Mexico (28,100 MT), Japan (25,200 MT), and the Philippines (20,000 MT).

Total corn sales at 457,000 MT were well below expectations of 750,000 to 950,000 MT, with Japan (254,800 MT, including 76,200 MT switched from unknown destinations) and Mexico (88,800 MT) the main homes.

Total net soybean sales of 347,700 MT were also a disappointment compared to expectations of 550,000 to 850,000 MT. Increases for China (339,100 MT, including 165,000 MT switched from unknown destinations), were partially offset by decreases for unknown destinations of 144,500 MT.

Also of note today is talk circulating that the large bad debt provisions made public by FC Stone yesterday, which saw it's shares fall by more than 61%, may see it forced to buy in short hedges in an attempt to protect it's capital base. If true that may provide some support to today's trade.

Early calls for this afternoon's CBOT session: July corn called steady to 3 cents lower; July soybeans called 4 to 6 cents lower; July CBOT wheat called 1 to 2 cents lower.

Russian Grain Crop Seen Lower In 2009

Russia will produce less grain in the coming season according to Arcadiy Zlochevskiy, the president of the Russian Grain Union.

Production will be a minimum of 80mmt, and could reach as high as 100mmt if the country gets "favourable weather conditions" he said.

That's a pretty wide estimate Arcadiy my son, nothing like playing safe eh?

Winter grains have been planted on 17.1m ha., he says. This is up 240,000 ha from last year.

Russia produced 108.1mmt of grain in 2008, so if we take the middle ground and go for a crop of 90mmt, that is 18mmt, or 16.7% lower.

Unfortunately, Arcadiy didn't give an estimate for wheat production specifically.

Still, this figure fits in quite nicely with the most recent estimate from SovEcon for a 2009 total grain crop of 87-96mmt.

Overnight Grain Markets

The overnight eCBOT grains are mixed with beans around 7 cents easier, wheat down 3-4 cents and corn nominally a cent or so higher.

The main factors driving the demise of soybeans the last few sessions are talk of Chinese cancellations and the expectation for a big increase in US plantings this spring.

In addition rains in Argentina appear to have arrived just in time to at least stabilise the soy crop.

Sharply higher US soybean plantings of course conversely mean lower corn acres. In addition corn export sales have been in excess of a million tonnes five weeks running, with another solid number expected this afternoon.

Reports of lower wheat acres around the world are filtering through to the market, which should provide solid underlying support. Russia continues to soak up most of the decent export orders however. Until the US and EU start picking up some of this business it may be difficult to get too much of a fire going underneath wheat.

In it's weekly export sales report due at 13.30GMT the USDA is expected to report corn sales of 750-950,000MT; wheat 300-400,000MT; soybeans 550-850,000MT.

RBS Reports Record Losses

The Royal Bank of Scotland has reported the largest ever loss in UK corporate history. A whopping GBP40 billion pre-tax was flushed down the lavatory at RBS in 2008. I wouldn't like to be the plumber called into unblock that baby, would you?

As the bank announced a sweeping restructuring plan shares jumped 30% in early trade, despite the losses.

As part of the plan up to 20,000 jobs could go. Why don't they start by "restructuring" former chief executive Sir Fred Goodwin's apologetic little face as he cashes in his fat £650,000 a year pension?

FC Stone Shares Drop Like Their Namesake

Shares in Kansas City-based commodity risk management company FC Stone Group plunged more than 60% Wednesday after it said that it may have to set aside up to $80 million to cover losses incurred on an energy account in it's second quarter.

This bad debt provision is in addition to $25.7 million set aside for similar reasons in Q1.

They didn't manage that risk very well did they?

Shares closed 61% lower at $1.54.

CBOT Closing Comments

Corn

March corn closed 9 1/2 cents higher. Attention is starting to focus on ideas that US farmers will plant a lot less corn in spring than they will soybeans. Whilst recent rain in Argentina may help soybeans it has maybe come too late to save corn. Tomorrow's USDA weekly export sales are expected to report another week of sales in excess of 1mmt, the sixth such week in a row, who says that demand is poor?

Soybeans

Beans had a bad day at the office relative to the other grains, with March closing down 3 cents. Argentina aren't on strike, China are maybe cancelling orders and US farmers are likely to plant a lot more beans in 2009 was enough to keep a lid on things today.

Wheat

March wheat ended up 9 1/2 cents buoyed by US weather concerns in the southern and central Plains. Lower winter plantings, reported by the CWB yesterday, may well be confirmed by USDA figures tomorrow. World-wide the outlook for global production in 2009 is turning significantly lower. One or two serious weather scares could potentially mean output being down as much as 100mmt in the coming season. That would keep stocks very tight and leave substantial upside potential for prices.

EU Wheat Closes Higher

May Paris milling wheat ended up EUR0.75 at EUR140.00/tonne Wednesday, whilst November London feed wheat closed up GBP1.50 at GBP124.00/tonne.

Russia continues to mop up most export orders kicking around, snapping up a Syrian wheat tender for 200,000mt yesterday after also taking a 240,000mt order from Egypt across the weekend. Algeria are said to be in the market for 300,000mt, I wonder who is going to pick that one up?

Crude oil was up, reaching the dizzy heights of $42/barrel, whilst the dollar was also a wee bit firmer against both the euro and sterling, helping EU wheat move higher.

Anyone would think that production was going to be lower in 2009. What, it is? Blimey!

UK Winter Wheat Plantings Sharply Lower

Our old chums at DEFRA have finally confirmed the evidence of my own eyes, saying that the UK's winter wheat area is 1.6m ha., down 0.3m ha from 1.9m ha last year.

That's a reduction of 15.8% according to my calculations. A reduction in production of that magnitude would slash 2.75mmt off our output this year giving us a crop of 14.75mmt.

And that is IF we were to achieve the same yield as last year. Unless you are a hermit living in a cave with broadband then you would probably be able to guess that we won't probably be matching last years' record yields.

So there we go boys & girls, we could be looking at a crop of around 14mmt this summer. That's the exportable surplus gone.

Ensus will be in the market looking for a million tonnes for their plant in Teeside by then too, followed by Vivergo looking for a similar amount for their Saltend plant in 2010.

No wonder I'm bullish.

eCBOT Close, Early Call

eCBOT grains closed modestly firmer with March beans up 3 1/4 cents, March wheat up 3/4 of a cent and March corn up 1 3/4 cents.

Crude oil is steady above $40/barrel for the time being, but the Energy Dept are out with their latest inventories report mid-session so things could change then. Crude stocks are expected to be up around a million barrels.

The Argy farmer/government talks threw up few surprises, and another meet is scheduled for next week. The recent strike finished yesterday and there are no more planned until at least March!

An unconfirmed story I am reading suggests that China may have cancelled 180,000mt of US soybeans purchases. That may cause a few ripples if it is true, as they have been far & away the biggest US home of late.

Algeria are shopping for 300,000mt of wheat. Russia must be the hot favourites to pick that order up having already pounced on similar tenders from Syria and Egypt in the past few days.

Weather in the US Plains remains a concern for US wheat prospects.

Early calls for this afternoon's CBOT session: Corn futures are expected to open 1 to 3 higher; soybeans 2 to 4 higher; wheat steady to 2 higher.

UK: OSR Crop Not Looking Good

Continuous cold wet weather and low soil temperatures have left oilseed rapes crops damaged by pigeons looking very poor and backward.

This season's crop is also blighted by the highest levels of light leaf spot since 1995 according to DEFRA.

They say that nationally infection levels are running around three times normal.

As well as widespread pigeon damage there are reports too of crops being been badly defoliated after the recent snows melted.

The Next Big Thing

A report from the Fairtrade Foundation reveals that in places like Uganda, Malawi, Nicaragua, India, Sri Lanka and parts of the Caribbean, poor families are spending up to 80% of their entire household budget on food items.

The cost of fuel and fertiliser means that in some cases families are missing meals, cutting the amount they plant or selling off their land.

If farmers in Europe and America are reducing plantings because the economics don't stack up, imagine what it must be like in some of these places.

With the global recession forecast to last well into 2010, food production, or lack of it, could well be a very serious problem sometime in the next 18 months.

Throw in a serious crop failure or two and we could be looking at a massive humanitarian disaster.

I hope I'm wrong.

Overnight Grains

The overnight grains are slightly firmer this morning, with beans around 6c higher and wheat and corn both 1-2c firmer.

Asian stock markets are up after their US counterparts gained the most in a month last night, as 230 point rally in the Dow lifted trader’s spirits.

Crude oil is a little firmer too, back up above $40/barrel, ahead of Energy Dept stocks data due later today.

No news came out of the Argy farmers meeting with the government who re-iterated their "the lady's not for turning" stance on export taxes.

US wheat crops face very dry conditions as they emerge from winter dormancy, and the forecast isn't for much relief anytime soon.

Conditions appear to have improved in China, especially in the south where around a third of their wheat crop is grown.

Argy Meeting Latest

News from the three hour meeting yesterday between Argy farm group leaders and the government is that some concessions were offered by the government in relation to milk and beef. Another meeting has been scheduled for next week.

The thorny issue of the soybean tax wasn't even discussed at this meeting it would seem. As that accounts for around 10% of all tax income received by the government they aren't going to want to give it up lightly. Especially not in the current economic climate, given the already precarious state of Argentine finances.

The Argy Production Minister Debora Giorgi ratified President Cristina Fernandez de Kirchner position that the controversial export taxes on soybeans, sunflower, wheat and corn remain at their current level. The simple truth is that they can't afford to do otherwise.

"It was a beginning; we’re not satisfied but what is important is that we are looking ahead and not backwards", said the president of the Argentine Rural Society, Hugo Biolcati.

Militant Argentine farmers ended the occupation of a bank branch in Entre Rios Province ahead of the meeting. The farmers had refused to leave the bank since Monday afternoon, demanding an explanation for steep hikes in variable interest rates charged on loans.

Anyone getting deja vu?

CBOT Close

Corn

March corn settled at $3.54 ¼, up 2 ½ cents in a relatively quiet session with mixed influences from Argentina, crude oil and the US dollar. The corn harvest looks pretty much buggered in Argentina, whilst things haven't been too bad in neighbouring Brazil. Still demand in the US also doesn't look too rosy on the back of subdued interest from the ethanol sector.

Soybeans

March soybeans finished at $8.81, up 8 ¼ cents, with support coming from the Argy farmers' strike, a weak dollar and firmer crude. The weather outlook in Argentina has improved for soybeans, but more help is needed analysts say.

Wheat

March CBOT wheat closed at $5.15 ¼, up 4 ¾, despite Syria buying 200,000mt of Russian wheat. Continued worries over the state of the US winter wheat crop underpinned CBOT futures. Also the CWB released lower than expected figures for US and Canadian production in 2009.

EU Wheat Ends Mixed; Heads, Sand Etc As CWB Cuts Global Production 50MMT

EU wheat futures closed narrowly mixed Tuesday with very little fresh fundamental news in the market.

Paris May milling wheat traded down EUR2.25 at EUR139.00/tonne, whilst London November feed wheat traded up GBP0.50 at GBP122.50/tonne.

Syria bought 200,000mt of Russian wheat, to add to last weeks order of 240,000mt of Russian wheat for Egypt.

At least some wheat is being bought on the export market. Even if it is all being mopped up by Russia.

It seems to me that the trade can see no further than the end of it's nose at the moment.

The CWB have just forecast Canadian and US production down by 16 and 15 percent respectively in 2009.

Large as they are, neither of those estimates don't even seem to take into account serious drought conditions in both countries as of yet. And things could be a lot worse than that in my opinion.

The CWB predict global wheat production of 633mmt in 2009, down from 683mmt in 2008. That is a serious loss of wheat. And suppose they are only half right. Is that a ludicrous assumption?

I don't think so. Just imagine wheat output in 2009 100mmt lower than in 2008. We'd have ending stocks of just a few weeks of supply. That is very very very tight indeed. Tighter than a tight thing on it's way to a tight things convention. We are talking TIGHT.

Here's a few figures: US production in 2009 is seen at 57.8mmt down from 68mmt according to the CWB. Canadian all wheat output in 2009 is predicted at 23.9mmt down from 28.6mmt, according to the CWB; EU-27 production is seen down from 150.5mmt to 140.0mt according to Strategie Grains; Russia down from 63mmt to 53.6mmt according to Informa; and Ukraine down from 25.5mmt to 19.1mmt according to UkrAgroConsult.

How much is that? Over forty million tonnes less, and that is without China, which could be down anything from 10mmt to 30mmt, maybe more. And Strat Grains are probably being over-kind to Europe. And none of these figures account for a weather problem. These are all based on lower plantings and a return to trendline yields. The US and Chinese crops are already at risk from failing to meet trendline yields.

That is a lot of wheat to go missing. Whilst global consumption is expected to reamin steady at 652mmt/per annum.

Is it just me here, or is everyone being blinded again? Last year it was how oil was going to $200/barrel plus and the only way was up, this year we are all doom & gloomed and the only way is lower.

I seriously believe that grain/food commodities will move very sharply higher and that they will probably be the first commodities to do so. Exactly when that will be of course is difficult to say. If we are optimistic I'd say in last half 2009, if we are more pessimistic then first half 2010.

Looking a little further ahead than that even, as the credit crunch continues to bite, if prices stay where they are or even fall further then plantings and inputs for the 2010 crop could be even lower.

Throw a crop disaster or two and potentialliy very tight 2009 ending stocks into that mix and we could be in a situation where the 2008 all-time high of £200/tonne wheat looks ludicrously cheap.

ABN Announces Purchase Of Flixborough Feed Mill, Mulls Invasion Of Poland

ABN have announced the acquisition of the Flixborough feed mill from JE Porter, pending regulatory approval from the UK competition authorities.

"We decided to purchase the Flixborough mill primarily because I don't think we've got a mill in a place with an X in it," said nobody to do with anything.

"Does anyone know if there a feed mill in Ashby de la Zouch, so then we would have a full set?" they didn't add.

"After that we might move onto punctuation marks like Westward Ho! If there isn't a mill there already then it might be a good idea to build one fast."

"We aren't expecting any trouble from the competition authorities as I think we own them already," the voices inside my head concluded.

Nobody was available to comment on totally unsubstantiated reports that the group were next considering an invasion of Poland, converting Buckingham Palace into a giant drive-through Primark or launching a hostile takeover of Alistair Darling's eyebrows.

North American Winter Wheat Conditions Far From Ideal, Output Declining

Wheat crops in North America are seen emerging from winter dormancy faced by what might be described as some very challenging conditions.

In Kansas dryness has intensified since December 1st in the leading US wheat state. Southwest Kansas is driest having received less than 20% of normal rainfall, while central Kansas has fared little better getting only 33% of normal moisture. Strong warming in February is coaxing wheat out of dormancy, creating a strong need for rainfall. In La Nina winters, the subtropical jet stream is suppressed, leading to fewer storms in the Southern Plains.

Oklahoma wheat farms are very dry. Conditions have declined here in the nation’s second biggest wheat state in a very dry winter. A moderate drought a month ago has become severe in the panhandle and southwest wheat districts, where only 25-30% of normal rainfall has been received since November 1st.

In Texas wheat conditions in the good to excellent category are just 12%, while the poor-very poor category is running at 58%. Condition ratings are similar to 1989, 1996, 2000 and 2006 – the worst production years in Texas history. More than half of the sown area was abandoned due to drought in each of those years. Seventy two percent of the crop was lost in 2006.

Canada’s western wheat provinces are also dry. Western Saskatchewan and eastern Alberta have received less than half of normal precipitation since September 1st and need generous spring rainfall for planting. The Canadian Wheat Board predicts a 16% cut in wheat production in 2009, due to depressed prices that encourage smaller plantings in the global economic downturn. They are also calling US production 15% lower in 2009 for similar reasons.

Canadian all wheat production will fall to 23.9mmt from 28.6mmt in 2008, whilst US output will drop to 57.8mmt from 68.0mmt last season, they say. Meanwhile world production will decrease 50mmt to 633mmt they predict.

eCBOT Close, Early Call

eCBOT grains closed a little lower with March beans down 5 3/4 cents, March wheat down 3 3/4 cents and March corn off 3 1/4 cents.

The Argy farmers strike is set to end today, and talks with the government begin. Just about the only thing that would surprise me there would be any kind of indication that some common ground had been found, and that another strike isn't lined up sometime at the start of March.

Crude oil and the dollar are steady for now.

Syria bought 200,000mt of Russian wheat in a tender. No surprises there then.

Argentine weather is forecast dry for the rest of the week and into the weekend. Although conditions have improved they are far from ideal.

Severe drought has already decimated Argentina’s corn and wheat crops but soybeans are coming on strong with heavy rainfall since January 25th. The leading soy districts in Santa Fe and Cordoba have received anywhere from 6 to 9 inches of rainfall in the past 4-5 weeks that has boosted pod filling. On the negative side, Buenos Aires soybeans have not recovered from drought and will produce a poor yield, but this province grows only 15-18% of the national soy crop.

In the US Texas remains in the grip of drought, with little relief in sight according to QT Weather.

Early calls for this afternoon's CBOT session: March corn called 2 to 4 cents lower; March soybeans called 5 to 7 cents lower; March wheat called 2 to 4 cents lower.

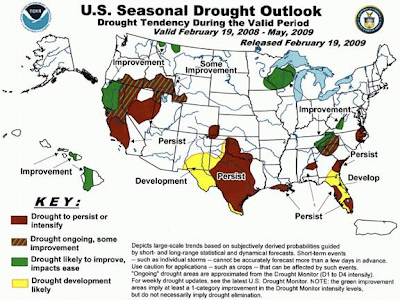

Texas Drought Set To Continue

The current extreme drought condition in Texas and the dry soil conditions in the US South and Southeast may continue to be of concern throughout the spring, says Allen Motew of QT Weather.

The poorest planting conditions are across Texas…the Southeast and Mid-Atlantic region is also anonomously dry, ranking in the 10-20 percentile range, he says.

The Seasonal Drought Outlook for spring expands the on-going drought conditions westward across Texas and further across Florida and South Georgia but shows improvement in parts of Virginia, Tennessee, North Georgia, and the Carolinas:

BP To Build World's Biggest Biofuel from Grass Plant

BP has this week announced plans to build what it claims will be the world's biggest facility for turning grass into biofuel, shelling out $112.5m investment for a 50 per cent stake in biofuels firm Verenium in the process.

The new facility will build on the company's existing partnership with Verenium, which has seen the two companies build a pilot plant in Louisiana. But the new Florida refinery will be 25 times bigger than the pilot plant, underlining the rapidly expanding interest in cellulosic ethanol, made from inedible plants, such as grass, rather than corn.

Carlos Riva, chief executive of Verenium, hailed the deal as "a critical next step" in the two companies' plans to commercialise cellulosic biofuels, that unlike corn-based biofuels should not have a knock on effect on food supplies and prices.

BP said that the Florida facility cost between $250m and $300m to build, but should produce 36 million gallons per year of fuel once it is operational. Ground will be broken on the site next year, with biofuel production scheduled to begin in 2012.

The joint venture company also intends to develop a second site in the Gulf Coast region.

The State of Argentine Agriculture

If you thought that the drought was over, read this report from the BBC. Argentines are famous carnivores consuming 70kg of beef per person per annum. They might have to start importing some of that before long, according to this report:

I'll just have the salad

Irish Firm Moves Into Pet Food

Irish animal health company Chanelle, which has an annual turnover of more than €60 million, has bought Dublin pet food firm PBS Sales for €4 million.

"This is our first acquisition and provides an excellent synergy to our existing business," said founder and managing director of the Chanelle group Michael Burke.

Chanelle began expanding beyond health products three years ago, and distribution of "Chanelle Pet Accessories" already accounts for €14 million of the group's annual turnover.

Chanelle now employs 240 staff, and has offices in Ireland, Britain and France. It is the largest veterinary pharmaceutical manufacturer in Ireland.

Crude Oil Lower Ahead Of Stocks Data

Crude oil is lower ahead of today's stocks data from the US Energy Dept., which is expected to show inventories rising by around a million barrels for the week ending Feb. 13.

The Dow Jones Index closed at it's lowest level since 1997 last night as the global economic situation worsens.

That doesn't forebode well for crude oil demand, if the market is going to rally then the supply & demand balance needs to be tipped in favour of demand.

US refineries are running at well below capacity, whist OPEC have cut production by around a million barrels/day, but still US stocks continue to rise.

Inventories at Cushing, Oklahoma - where the West Texas contract is based - have reached all-time highs, pushing Brent to around a two dollar premium over the US contract whereas it normally trades at a discount.

McDonalds Sales Thriving in Recession

This current difficult environment is sending a lot of consumers scrambling for cheaper alternatives in dining. That is where McDonald’s distinguishes itself. With January same-store-sales up more than 7% worldwide – even in the face of the global financial meltdown – McDonald’s is proving that it can not only execute, but thrive. Indeed, sales in Asia were up 10%, while those in Europe were up 7%. Even U.S. sales were up 5%.

McDonald’s is the unparalleled leader in the arena of quick service and value dining. With roughly 31,000 restaurants in 118 countries, a balance sheet laden with $1.5 billion in cash and a size and market capitalization that dwarfs the competition, it is almost impossible to compete against the Golden Arches.

It doesn’t stop there, either: In an environment such as this one, the strong get stronger and run away with the market as the weak disappear..

The Oak Brook, Ill.-based McDonald’s is the world’s leading food-service retailer, with more than 30,000 local restaurants serving 52 million people in more than 100 countries every day. More than 70% of McDonald’s restaurants are owned by independent local men and women. McDonald’s is also one of the world’s most-recognizable and most-valuable brands.

Not only is McDonald’s the largest, but its huge geographic diversification and economies of scale imbues the company with its many enduring competitive advantages. These advantages result in huge cost savings that are not as important in good times, when the industry has runaway pricing power. During lean, economic times, however, those cost savings are the difference between life and death.. If you are a supplier, and you sell to the Golden Arches – much like selling merchandise to Wal-Mart – you have very little bargaining power.

To the advantages related to economies of scale and migration to cheaper alternatives by consumers, you need to add the renewed inflation policy and the drop in commodity prices. Other than the cost of chicken, which is about 10% higher than last year, all other key food ingredients have dropped between 5% (beef) to 45% (milk). This will show up nicely in McDonald’s margins, which, coupled with sales growth, will give the company’s bottom line a nice push higher.

Who says that you cannot expand profits in a recession?

Overnight Grains

The overnight eCBOT grains are a tad lower Tuesday morning in a dearth of fresh fundamental news.

Falling crude oil and the general global economic depression are enough to weigh on the sector this morning.

Argy farmers have a meeting with the government scheduled for later today. Their recent strike is supposed to end today, we will see what happens from here on in, but this one can be expected to run & run methinks.

Above normal precipitation fell across Northeast China last week (Feb 14-21) but more rain and snow is needed to alleviate drought conditions there, according to Allen Motew of QT Weather. Heavy precipitation will fall mid-week over the Yangtze Basin with no precipitation farther north across China’s Winter Wheat Belt, he adds.

The newly released outlook for March shows drying for the Southern Plains, Gulf States and Southeast. Early season row crops may get off to a poor start if this forecast verifies, he concludes.

China has bought at least 90,000mt of soyoil the last few days and is actively seeking more according to media reports.

EU Wheat Ends Flat

EU wheat futures closed around unchanged levels Monday in a subdued start to the weeks trading.

May Paris milling wheat ended up EUR0.25 at EUR141.25/tonne, and May London feed wheat closed unchanged at GBP112.00/tonne.

Russia bought 240,000mt Russian wheat in a tender over the weekend, passing on more expensive US and EU wheat. It has to be said that Russia again picking up the order was not exactly a huge surprise.

A wet weekend in South America also helped ease crop concerns there, although in Argentina at least it may have come too late to help the corn crop.

We will shortly get a clearer picture of the health and potential size of the EU wheat crop as it emerges from dormancy, with most analysts expecting a crop around 10mmt lower than in 2008.

Question marks still remain over the size and health of crops in major producing countries such as the US and China.

Chicago Closing Comments

Corn

March corn at finished $3.51 ¾, up 1 ½ cents December corn finished at $3.91 ½, up 1 ¾ cents. Corn opened higher but drifted throughout the day to only close with modest gains. A weaker dollar and the farmers strike in Argentina was supportive, but throughout the session a falling Wall Street and crude oil price weighed on corn by the end of the day.

Soybeans

March soybeans closed at $8.72 ¾, up 10 ¼ cents November soybeans closed at $8.40, up 9 ½ cents. Beans were more than 30 cents higher early in the session but gave up a fair slice of those gains later on as the stock market declined, with Wall Street closing at it's lowest level in twelve years. The Argy strike is supportive for beans, but looking further ahead the chance of US farmers planting anything up to 6m acres more soybeans for the 2009 harvest is ultimately bearish longer term.

Wheat

March CBOT wheat settled at $5.10 ½, down 8 ¾ cents. Egypt passing on US wheat in favour of Russian grain was viewed as bearish, although dryness in the US Plains remains a concern. A sharply lower stock market and continued concerns over the economy weighed on wheat later in the day.

Cargill Made My Daughter Cry

The Mail on Sunday carried a report at the weekend about a debt collection agency called Phoenix Recoveries (UK) Limited Sarl reducing some poor girl to tears chasing her for a five hundred quid catalogue debt that wasn't hers.

What does Sarl mean? Despite their highly misleading moniker, this company is registered in Luxembourg where Sarl is the equivalent of "limited" - so this is a foreign company pretending to look British.

But to get a debt collectors licence in this country you need a British address. And the one they have supplied is none other than Cargill's head office in Cobham!

Boooooo hissssss make the big bad man go away Daddy

eCBOT Close, Early Call

The overnight grains closed sharply higher, reversing Friday's losses on a weaker dollar on talk that the US government may increase it's stake in Citigroup to 40 percent.

March soybeans closed the eCBOT session 18 1/2 cents higher, Mar wheat up 7 1/4 cents and Mar corn 9 1/4 cents firmer.

An improved weather outlook in South America over the weekend was largely ignored, with traders focusing their attention on the currency market.

The Wall Street Journal reported that Citi has proposed that the government convert a large portion of its preferred shares into common stock, thereby raising its interest in the firm without costing taxpayers any more money.

It seems that much of last weeks losses in the grain markets were due to outside influences and speculative money exiting. CFTC data shows that corn's long positions were almost completely eliminated in the week to Feb. 17, whilst soybean long positions fell 20 percent, while wheat short positions rose 16 percent.

As was largely expected Egypt bought 240,000mt of all-Russian wheat over the weekend.

Argentine farmers began what seems destined to be the first of many strikes late last week ahead of planned talks with the government tomorrow. I don't think anyone is really expecting much chance of a resolution at this early stage.

That may add a bit of a front-end premium to soya values over the next few months.

Early calls for this afternoon's CBOT session: Corn futures are expected to open 6 to 9 higher; soybeans 18 to 20 higher; wheat 5 to 7 higher.

Banned Additive Found In Chinese Pig Feed

A total of 46 people were poisoned in South China’s Guangdong province this week after having eaten pig organs that contained a banned animal-feed additive, according to news agency Xinhua.

All the people were hospitalised for stomach aches and diarrhoea. Three people remained in the hospital for further observation, said Wang Guobin, an official with the Guangzhou Municipal Public Health Bureau.

Wang said all of them had eaten pig organs, which, according to an initial investigation, were contaminated by the feed additive clenbuterol.

The chemical can prevent pigs from accumulating fat, but is poisonous to humans and can be fatal. It is banned as an additive in pig feed in China and in most other countries of the world.

Wang said a further investigation is underway to find out the source of the additive.

EU To Introduce Anti-dumping Levy On US Biodiesel

According to a story on Reuters the European Commission is planning to propose anti-dumping and anti-subsidy duties on imports of biodiesel from the United States.

The anti-dumping duties would range from 2 euros ($2.50) to 19 euros per 100 kilograms and the anti-subsidy duties from 23 to 26 euros per 100 kg, they say.

The Commission is due to propose the measures at a meeting next month.

Not before time either, the US have been taking the mickey for far too long with their splash & dash shinanegins. And if they want to ban the import of Roquefort cheese on the back of it then fine.

Argentina Weekend Weather

Thanks to my man in Uruguay, Jose, for this map of precipitation in Argentina for the 24 hour period ending 9am 22nf Feb:

Heavy rains fell in central growing regions of Argentina while lighter amounts or no rain fell in southern Buenos Aires, across the weekend report Allen Motew of QT Weather. The week ahead will be much dryer and cooler as maximum readings drop into the 70’s and no rain will fall, he says, but heavy rain is now shown by the GFS for next week.

Rains were heaviest in Santiago Del Estero, San Luis, and Entre Rios in Argentina, across northern Uruguay and in Rio Grande Do Sul in Brazil, with many one to three inch amounts.